Daily technical highlights - (SUPERLN, JOHAN)

kiasutrader

Publish date: Fri, 14 Jul 2017, 11:47 AM

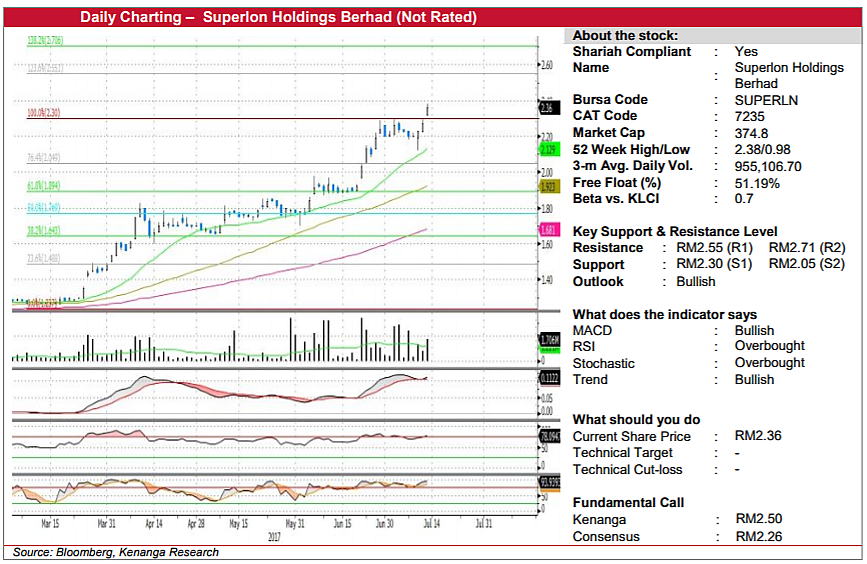

SUPERLN (Not Rated). Yesterday, SUPERLN rose 9.0 sen (4.0%) to close at RM2.36. Yesterday’s move marks as a breakout from a previous short sideways consolidation phase, and the RM2.30 resistance level which it retested thrice in the past one month. Resuming its uptrend, the share continued to trade above all key SMAs, with all key indicators also experiencing an uptick following yesterday’s move. From here, we expect the share to trend towards the next resistance at RM2.55 (R1). Breaking past that, another resistance can be identified at RM2.71 (R2). As for supports, there is the aforementioned resistance-turned-support of RM2.30 (S1), as well as RM2.05 (S2). Further below, a stronger support can be identified at RM1.89 (S3).

JOHAN (Not Rated). JOHAN caught our attention yesterday after spiking 4.5 sen (18.4%) to close at RM0.29. This was accompanied by exceptionally high trading volumes, with 23.9m shares changing hands yesterday, around 6x its 20-day average of 3.8m shares. The MACD is also in an ascending trend for the past month, with yesterday’s move nudging it above its Signal and zero line. Despite so, expect some overhead resistance at RM0.30 (R1) and RM0.32 (R2), with a stronger resistance higher up at RM0.35 (R3). While some support can be found at RM0.28 (S1), we prefer the stronger supports further below at RM0.25 (S2), and RM0.21 (S3)

Source: Kenanga Research - 14 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)