Daily technical highlights - (LSTEEL, AYS)

kiasutrader

Publish date: Fri, 28 Jul 2017, 09:42 AM

LSTEEL (Not Rated). LSTEEL’s share price climbed 2.5 sen (4.3%) yesterday to a closing high of RM0.61. Trading volume was elevated at 2.1m or double the daily average. Notably, the share price has broken out of its short-term downtrend channel as a result of the bullish move yesterday. At the same time, the MACD has just crossed above its Signal-line while the RSI and Stochastic indicators have hooked upwards into the bullish territory. Combined, these signaled the start of a short-term up-cycle, though more suited for scalp traders. From here, we expect follow-through momentum to carry the share price towards resistance levels RM0.635 (R1) and RM0.665 (R2). As for the downside, support levels are RM0.59 (S1) and RM0.54 (S2).

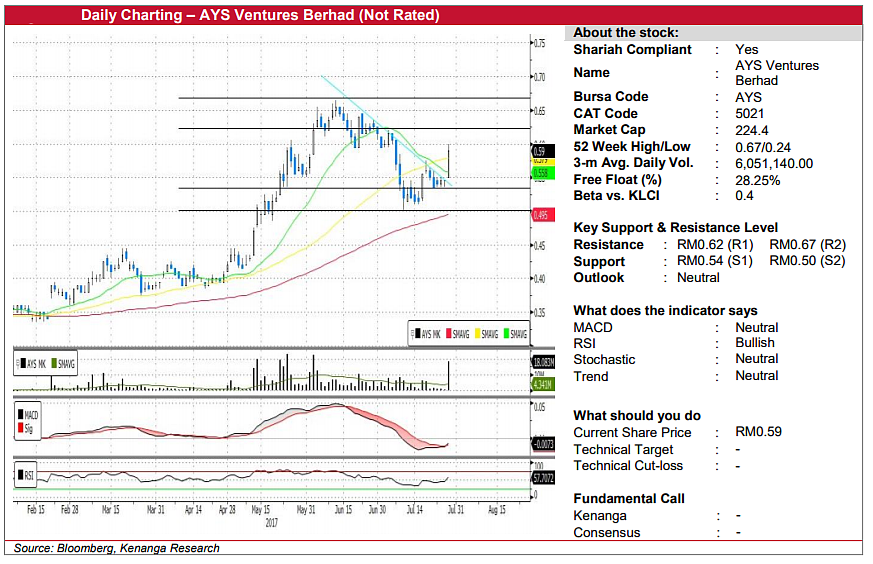

AYS (Not Rated). AYS surged 8.25% to close at RM0.59 yesterday on increased trading volume of 18.1m shares as compared to its volume 20-day average of 4.3m shares. Yesterday’s gains signalled not only a consolidation breakout, but also a decisive move above the 20-day SMA. The surge brought an uptick to RSI while MACD has now intersected its Signal line from below. As such, we believe that the balance of evidence favours the upside in the near-term. Immediate resistance level to look out for is RM0.620 (R1). Further up will be RM0.67 (R2) placed at the 52-week high. Conversely, the support levels are RM0.54 (S1) and a range of RM0.50-RM0.51 (S2).

Source: Kenanga Research - 28 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Feb 03, 2025

Created by kiasutrader | Feb 03, 2025

Created by kiasutrader | Jan 31, 2025