Daily Technical Highlights - (COMFORT, SYSTECH)

kiasutrader

Publish date: Wed, 02 Aug 2017, 11:23 AM

COMFORT (Not Rated). Yesterday, COMFORT climbed 5.0 sen (5.4%) to close at a 2-year high of RM0.98. This was accompanied by exceptionally high volume, with 23.5m exchanging hands, almost 5-fold its average of 4.8m shares. Chart wise, yesterday’s move marks a decisive breakout above its previous high at RM0.945, as well as serving as a third day of continued gains following a prior month-long consolidation period. Key indicators also appear to be in a bullish-state, with an uptick in the RSI coupled with a bullish crossover from the MACD against its Signal-line. Likewise, key SMAs also has remained in a “Golden Cross” since May. From here, we expect the share to trend towards resistances RM1.02 (R1) and RM1.06 (R2). Downside support can be found at RM0.855-0.87 (S1), with another support at RM0.785-0.795 (S2) below.

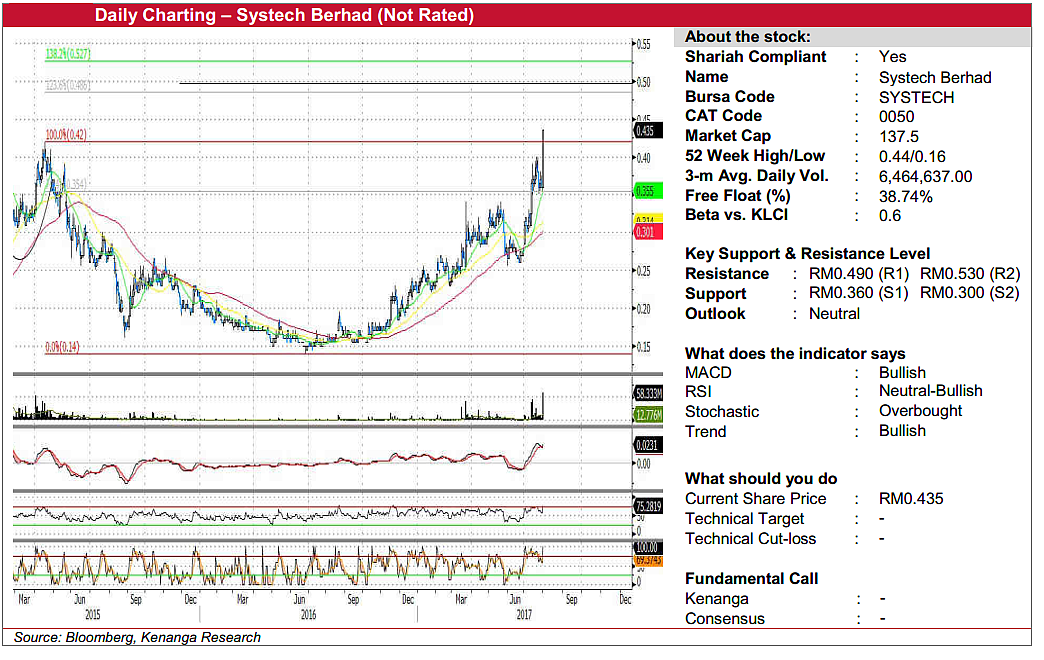

SYSTECH (Not Rated). SYSTECH saw its share price surging 7.5 sen (20.8%) yesterday to a new high of RM0.435 after its annual general meeting the day before. According to the news wires, SYSTECH expects its cyber security subsidiary to contribute 50.0% to its revenue in FY18 after they broke even last year. After a few weeks of downwards consolidation, yesterday’s breakout can be construed as a continuation of an overall uptrend, supported by strong volume with 58.3m shares traded. With the key indicators mostly in a bullish state, we expect the share price to be positively biased from here. Resistance could be found in the range of RM0.490-RM0.500 (R1) while the next resistance is placed at RM0.530 (R2). Any downside towards the RM0.350-RM0.360 (S1) support level may be viewed as a buying opportunity, while a break below the key psychological level of RM0.300 (S2) would be a huge negative.

Source: Kenanga Research - 2 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)