Daily Technical Highlights - (TAWIN, KESM)

kiasutrader

Publish date: Tue, 08 Aug 2017, 10:25 AM

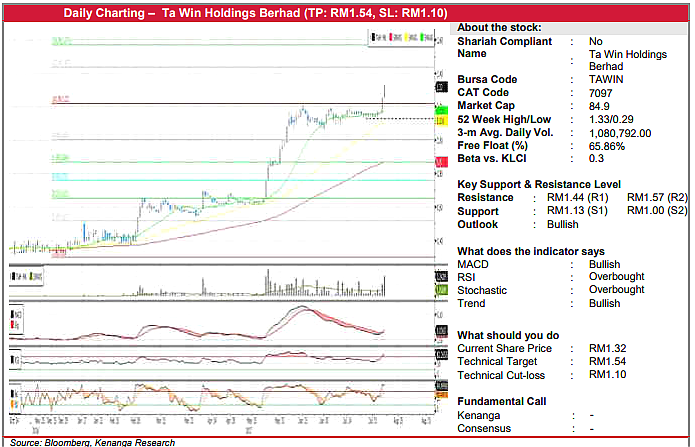

TAWIN (TP: RM1.54, SL: RM1.10). TAWIN has performed remarkably since our first Trading Buy call on the stock (report dated 16-Mar-2017), having gained 69.5 sen and racking in a total return of 112.9% since then. Yesterday, the share rallied another 7.0 sen (5.6%), accompanied by increased trading volumes, with 3.2m shares exchanging hands, nearly 3x its daily average volume of 1m shares. We believe the overall technical picture still remains intact, with yesterday’s move marking a second day of breakout from a prior sideways consolidation since June. Likewise, key-indicators also followed suit with positive showing, with the MACD experiencing a bullish crossover against its Signal-line. As such, we are adjusting our technical target and stop-loss upwards to let the profits run.

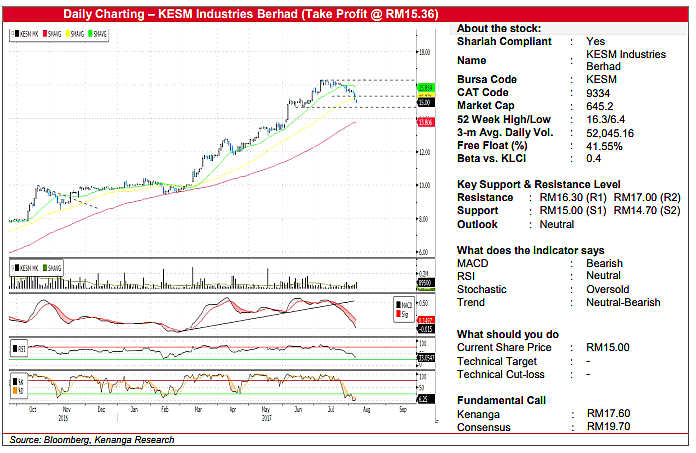

KESM (Take Profit @ RM15.36). Previously, we called a Trading Buy on KESM (report dated 11-Nov-2016 @ RM9.15) and subsequently revised our technical target price/stop-loss upwards (report dated 7-July-2017) after our initial target price was met. The share price has since mostly performed to our expectations, having sustained a steady uptrend over this period. Nevertheless, the past month has seen some momentum-loss, evidenced by the MACD’s trend break and more recently, the share price’s move below its 20- and 50-day SMAs. With the share price having breached below our recently revised stop-loss of RM15.38, we opt to take profit on the counter for a 69.2% gain (inclusive of 12.5 sen in dividends). We will, however, revisit the counter should the technical picture turn more favourable. Immediate support levels are RM15.00 (S1) and RM14.70 (S2) while resistances are located at RM16.30 (R1) and RM17.00 (R2)

Source: Kenanga Research - 8 Aug 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024

Created by kiasutrader | Nov 27, 2024