Daily Technical Highlights - (KPS, AEMULUS)

kiasutrader

Publish date: Wed, 13 Sep 2017, 10:58 AM

KPS (Not Rated). KPS’ share price rose 7 sen (5.3%) yesterday to finish at the day’s high of RM1.38. The share price has been on an uptrend since early last year and had pulled back to the uptrend support line in recent months. Nevertheless, yesterday’s move marks yet another departure from the uptrend line – potentially signalling that the share price is poised to kick off the next leg higher. While trading volume clocked-in at just 232k shares, it is more than double the daily average over the past month. At the same time, key indicators such as the RSI and Stochastic have also hooked upwards to reflect this view. From here, expect further gains in the coming months towards the next resistance levels at RM1.45 (R1) and RM1.58 (R2). Any near-term weakness back to RM1.30 (S1) may be viewed as a buying opportunity, although a break below RM1.26 (S2) would be a huge negative.

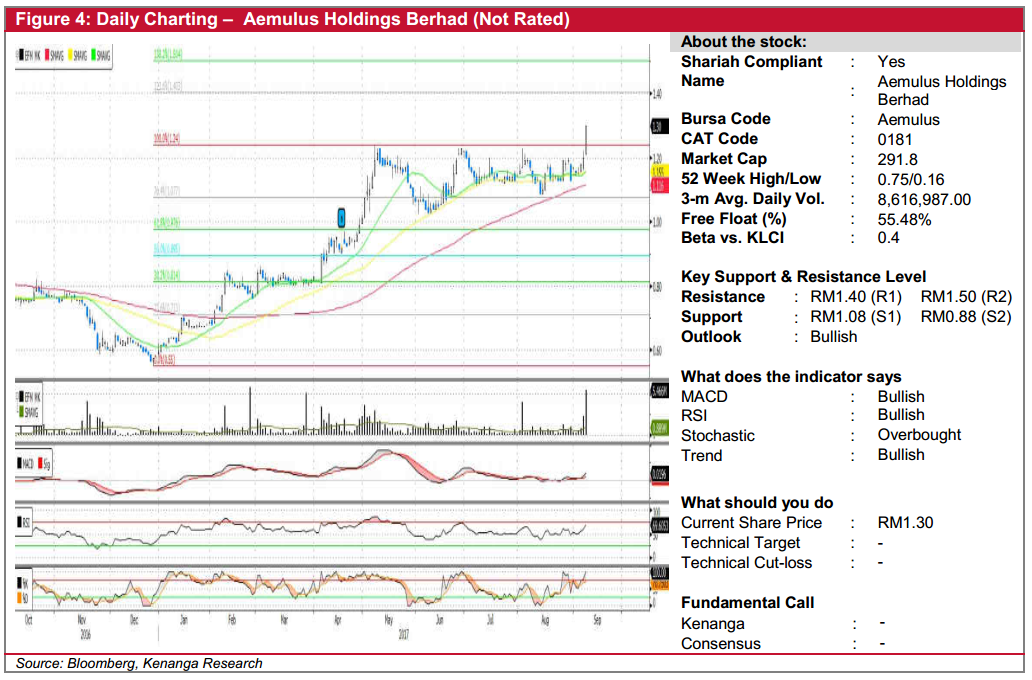

AEMULUS (Not Rated). AEMULUS gained an impressive 7.5 sen (+12.7%) yesterday to finish at day’s high of RM0.665, backed by exceptionally high trading volumes with 28.4m shares exchanging hands – well more than double of its daily average. More importantly, yesterday’s move marks the first bullish move in the past 2 months of sideways consolidation, potentially signalling a continuation of a prior uptrend since beginning of the year. Likewise, key technical indicators have also displayed positive upticks, with key SMAs also in a state of a “golden-cross”. As such, given sustained momentum, expect the share to trend towards its previous high RM0.75 (R1), while a significant break beyond could see a higher resistance at RM0.89 (R2). Conversely, downside support can be found at RM0.53 (S1) and RM0.46 (S2) further below.

Source: Kenanga Research - 13 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)