Daily Technical Highlights - (APPASIA, BSTEAD)

kiasutrader

Publish date: Wed, 27 Sep 2017, 09:27 AM

APPASIA (Not Rated). Yesterday, APPASIA’s share price climbed 3.5 sen (10.4%) to finish at RM0.37 on increased volume of 3.0m shares. As a result of the bullish move, the share price has broken out of its 5-month long down trend. Key momentum indicators have also hooked upwards into bullish regions to reflect this shift in sentiment from bearish to bullish. Next up, we expect a retest of the July high of RM0.39. Should this crucial level be taken out next, we would then expect a further climb towards RM0.42 (R1) and possibly RM0.455 (R2) next. Downside support is located at RM0.35 (S1) and RM0.31 (S2) below.

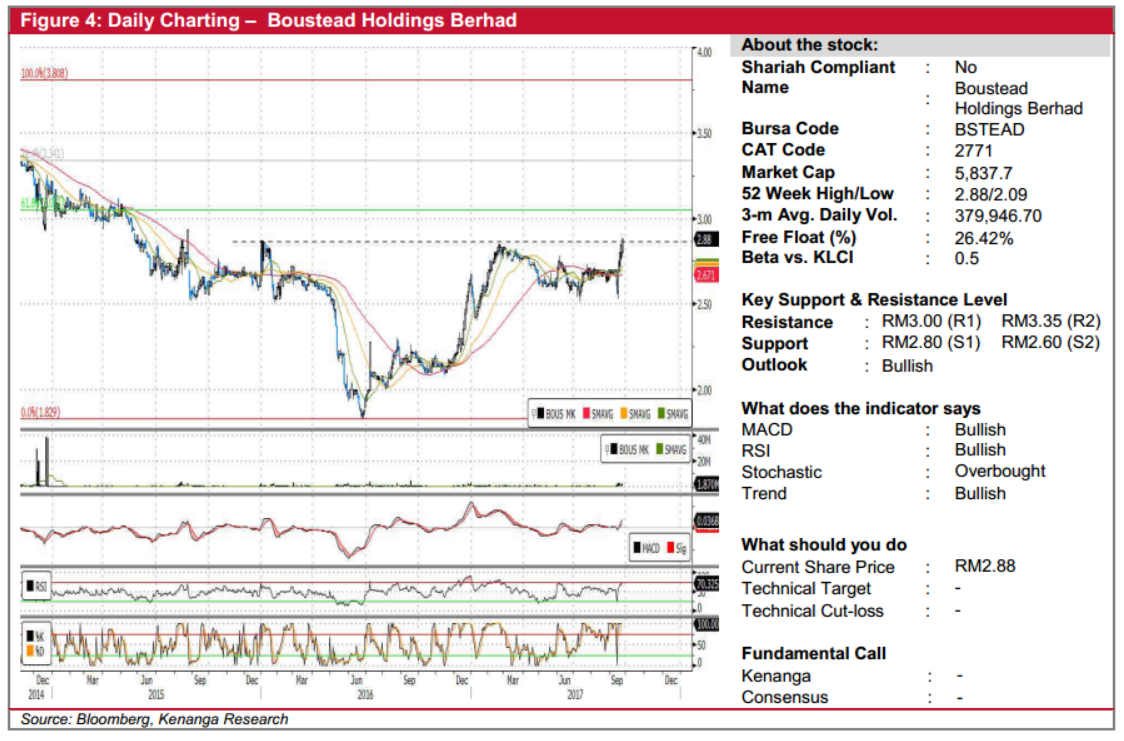

BSTEAD (Not Rated). BSTEAD’s share price closed at a 2-year high yesterday, after it gained 4 sen (1.4%) to RM2.88. Earlier this month, BSTEAD’s share price broke out of a 6-month downtrend channel. However, it wasn’t until yesterday’s bullish move that the share price signalled a more decisive recovery, having taken out the crucial RM2.85 resistance. Similarly, the momentum indicators have now shown a marked improvement, leading us to believe that the share price is now poised for further gains ahead. From here, we reckon that BSTEAD has a fairly clear path towards resistance levels RM3.00/RM3.05 (R1) and possibly RM3.35 (R2) next. Downside support levels are likely at RM2.80/RM2.85 (S1), failing which, additional support is located at RM2.60 (S2)

Source: Kenanga Research - 27 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|