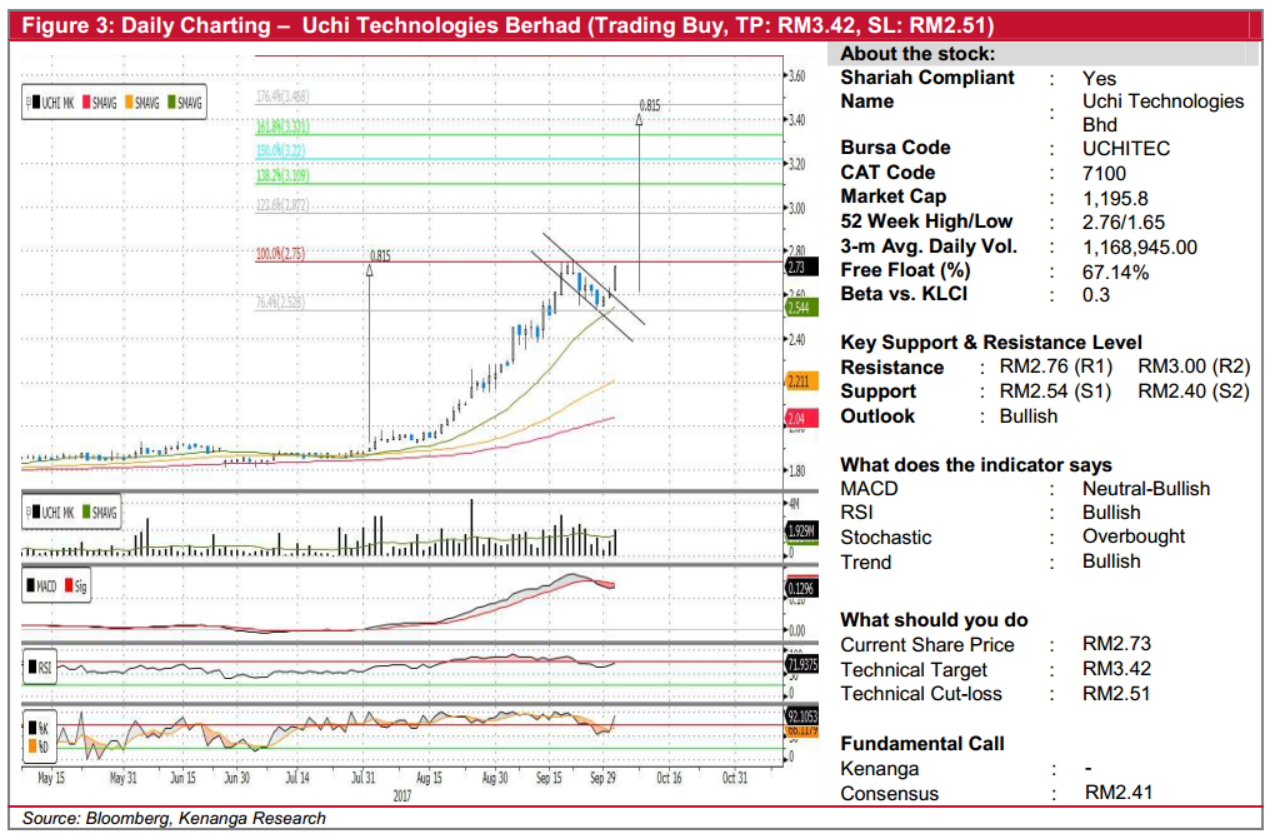

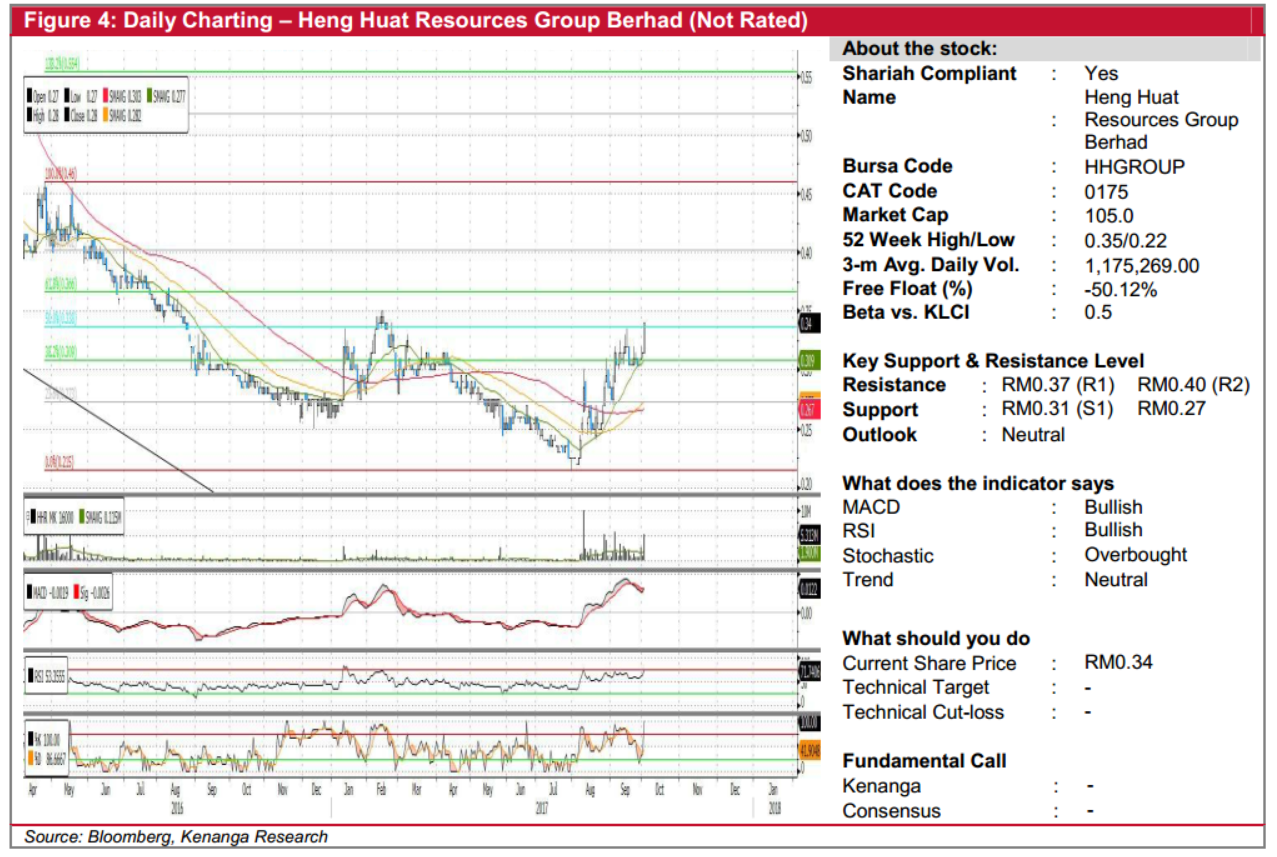

Daily Technical Highlights - (UCHITEC, HHGROUP)

kiasutrader

Publish date: Wed, 04 Oct 2017, 09:51 AM

UCHITEC (Trading Buy, TP: RM3.42, SL: RM2.51). UCHITEC’s share price climbed 13.0 sen (5%) to close at RM2.73 yesterday on increased trading volume of 1.9m shares. Earlier in August, UCHITEC kicked off a strong rally after the share price broke out of its sideways trend at RM2.00, and subsequently climbed to a high of RM2.76 within a month. The share price then staged a minor pullback, before marking yet another breakout yesterday. With the bullish move, we believe that UCHITEC is poised for the next stage of the rally after a brief pause for breath. Momentum indicators have also experienced an uptick to reflect this view. Based on the “Flagpole” measurement objective, we see the potential for a move to RM3.45. In between, resistance levels to look out for include RM2.76 (R1) and RM3.00 (R2) while downside support levels are RM2.54 (S1) and RM2.40 (S2).

HHGROUP (Not Rated). HHGROUP gained 2.5 sen (7.9%) yesterday, decisively breaking out from its week-long sideways consolidation and closing at RM0.34. More importantly, we believe that yesterday’s move could potentially be a further indication of a larger reversal from its long downtrend since late-2015. This is backed by key SMAs having recently turned into a “Golden Cross” state, coupled with the positive uptrend from key-indicators. Furthermore, notable are the strong trading volumes since the share bottomed-out in early August, as compared to stagnating volumes in large parts throughout its downtrend, thus suggesting a possible reversal of sentiment. From here, Fibonacci Retracement analysis derived resistance levels at RM0.37 (R1) and RM0.40 (R2), while downside supports can be identified at RM0.31 (S1), and RM0.27 (S2).

Source: Kenanga Research - 4 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|