Daily Technical Highlights - (PETRONM, PCHEM)

kiasutrader

Publish date: Thu, 28 Dec 2017, 09:52 AM

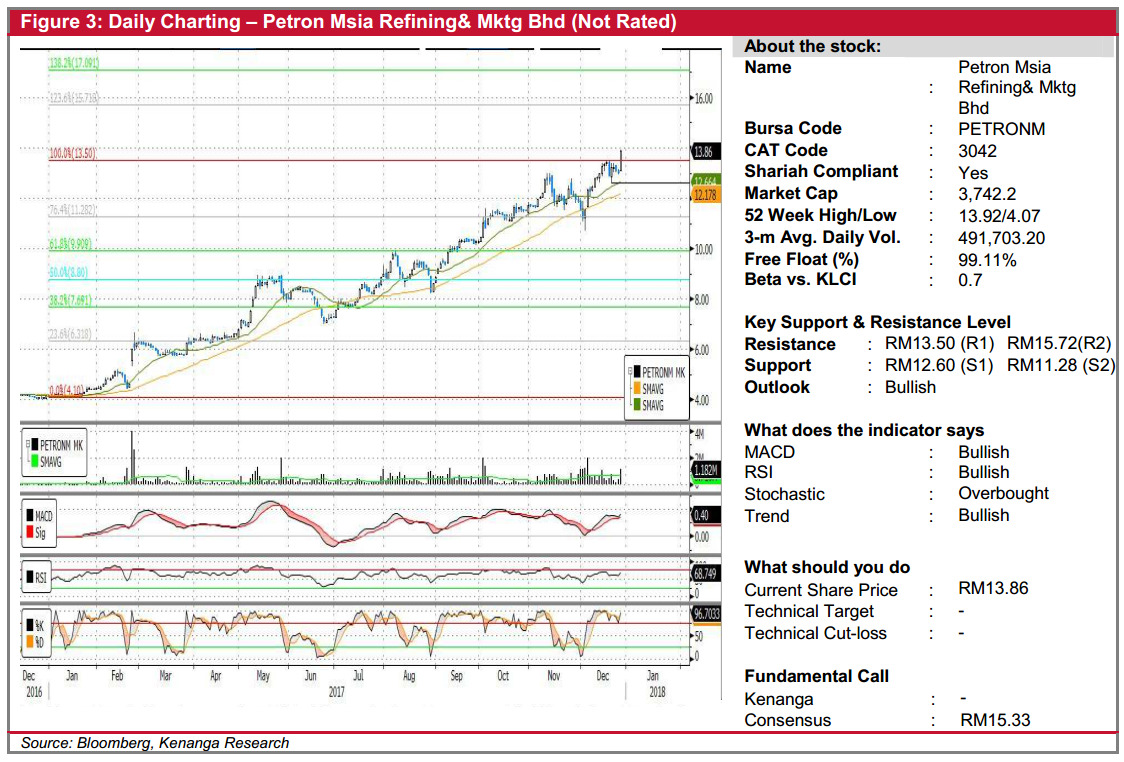

PETRONM (Not Rated). PETRONM gained 82.0 sen (6.3%) to finish at an all-time high of RM13.86 on the back of decent trading volume of 1.2 shares exchanging hands. From a charting perspective, PETRONM spent most part of the year trending upwards making higher highs and higher lows. Following yesterday’s breakout from its all-time high, we reckon PETRONM’S share price is poised for the next climb. Notably, positive hook-up in key indicators such as MACD and RSI, further supports the overall bullish technical outlook. From here, we believe PETRONM is on a clear path higher towards RM13.50 (R1) resistance level and RM15.72 (R2). Conversely, immediate support level can be found at RM12.60 (S1) and further below at RM11.28 (S2).

PCHEM (Not Rated). PCHEM’s share price rose 20.0 sen (2.6%) to close at RM7.80. Chart-wise, yesterday’s close suggested the share price will stage a continuation of its six-month major bullish trend. Given momentum indicators such as MACD at above signal line and uptick in RSI venturing close to the overbought level, we expect the share price to likely punch through above the RM7.80 level soon. Should follow-through buying interest carry on over the next few days, the stock could gear upwards towards RM8.00 (R1) psychological resistance level or further higher at RM8.18 (R2). Downside support levels include the former resistance-turned-support at RM7.56 (S1) and RM7.42 (S2) below.

Source: Kenanga Research - 28 Dec 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-27

PCHEM2024-11-26

PCHEM2024-11-25

PCHEM2024-11-25

PCHEM2024-11-25

PCHEM2024-11-25

PCHEM2024-11-23

PCHEM2024-11-22

PCHEM2024-11-22

PCHEM2024-11-22

PCHEM2024-11-22

PETRONM2024-11-22

PETRONM2024-11-22

PETRONM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-21

PCHEM2024-11-20

PCHEM