Kenanga Research & Investment

Daily Technical Highlights – (VITROX, SCIENTX)

kiasutrader

Publish date: Fri, 09 Feb 2018, 08:55 AM

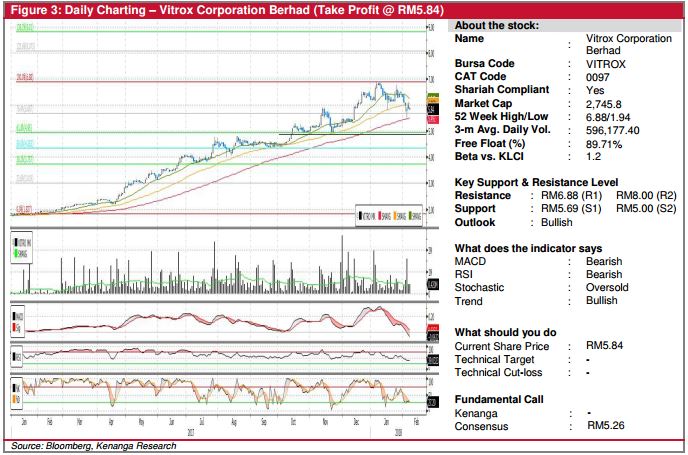

VITROX (Take Profit @ RM5.84)

- We previously recommended a Trading Buy call on VITROX dated 13 October 2017 (LP: RM4.86, TP: RM7.46) after the stock staged a technical breakout.

- The technical outlook of VITROX has deteriorated in recent weeks as evidenced by the MACD “Bearish Convergence”.

- Given the likely tepid outlook in the short-immediate term, we opt to secure profit on the stock (20.2% gain) for now and will re-look the stock once its technical picture turns compelling again.

- Immediate resistance levels to look out for are RM6.88 (R1) and RM8.00 (R2), while downside support levels are RM5.69 (S1) and RM5.00 (S2).

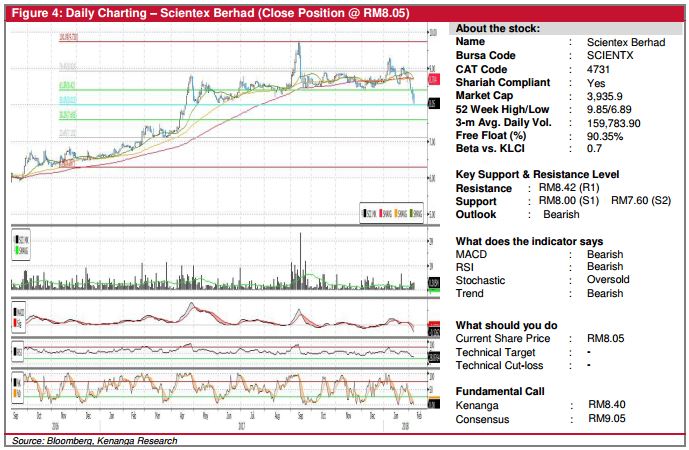

SCIENTX (Close Position @ RM8.05)

- Following our technical “Trading Buy” call on SCIENTX in September 2017, the share advanced upward and notched a high of RM9.69

- However, the bullish run was short-lived as the price quickly went down and remained in consolidation for the next 4 months.

- Amidst the past 2 weeks of bearish performance, overall technical picture has deteriorated and momentum indicators are showing a bearish convergence.

- With a few signs of a lasting relief, we opt to close position for now. Traders could, however, consider selling on strength towards RM8.42 (R1). Immediate support levels can only be found at RM8.00(S1) with further support at RM7.60(S2).

Source: Kenanga Research - 9 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments