Kenanga Research & Investment

Daily Technical Highlights – (FGV, SUPERLN)

kiasutrader

Publish date: Wed, 21 Feb 2018, 09:12 AM

FGV (Not Rated)

- FGV rose 8.0 sen (4.1%) to close at RM2.03, accompanied by trading volume of 13.1m – above average volume of 10.3m.

- Amidst past two consecutive days of bullish price performance, the share has penetrated through RM2.00 psychological level, which coincides with 76.4% level of Fibonacci Retracement.

- Technical outlook is turning positive with MACD-Signal Line crossover and upticks in other oscillators.

- Foresee follow-through buying towards RM2.18 (R1) and RM2.33 (R2) further up.

- Support levels can be found at RM1.92 (S1) and RM1.85 (S2).

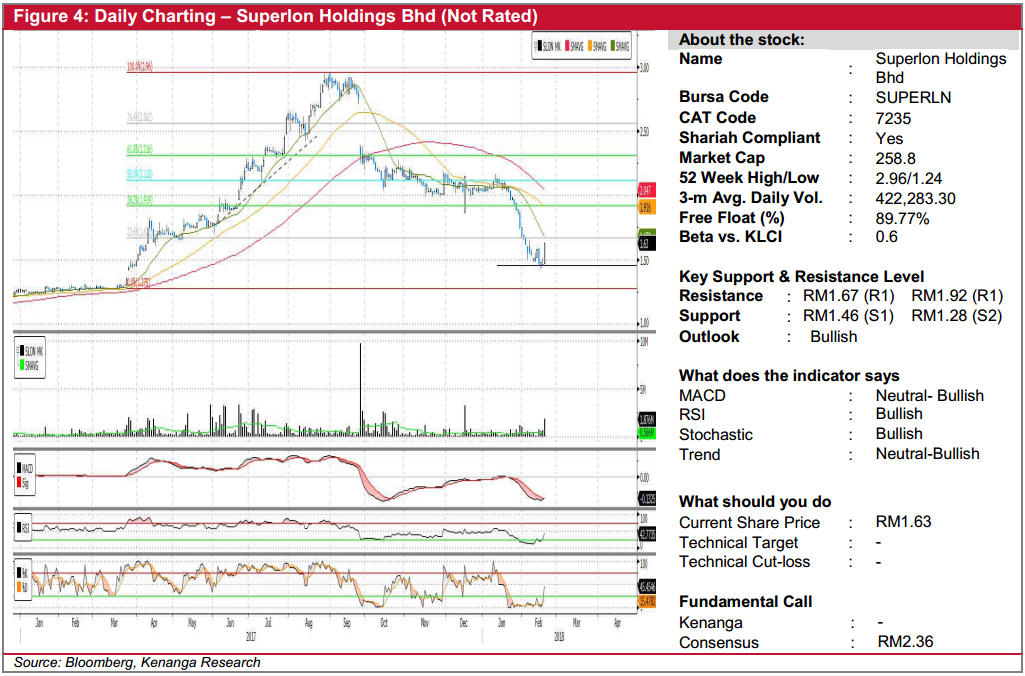

SUPERLN (Not Rated)

- SUPERLN surged 17.0 sen (11.64%) to close at RM1.63 on stronger trading volume at 1.9m shares.

- Yesterday’s bullish candlestick indicates that the share price has potentially bottomed-out from its 5-month major downtrend.

- Positive momentum indicators such as upticks on both RSI and Stochastic as well as MACD-signal line in crossover state to signal recovery play on the cards.

- From here, key resistances to look out for are RM1.67 (R1) and RM1.92 (R2). Conversely, immediate support can be identified at RM1.46 (S1) and RM1.28 (S2) further down.

Source: Kenanga Research - 21 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Pharmaniaga - Better outlook at medical supply unit, PN17 Stays

Created by kiasutrader | Nov 27, 2024

Malaysia Airports Holdings - Buoyed by High-Yielding Passengers

Created by kiasutrader | Nov 27, 2024

Actionable Technical Highlights - INFOLINE TEC GROUP BHD (INFOTEC)

Created by kiasutrader | Nov 27, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments