Kenanga Research & Investment

Daily technical highlights – (D&O, AEON)

kiasutrader

Publish date: Fri, 13 Apr 2018, 09:19 AM

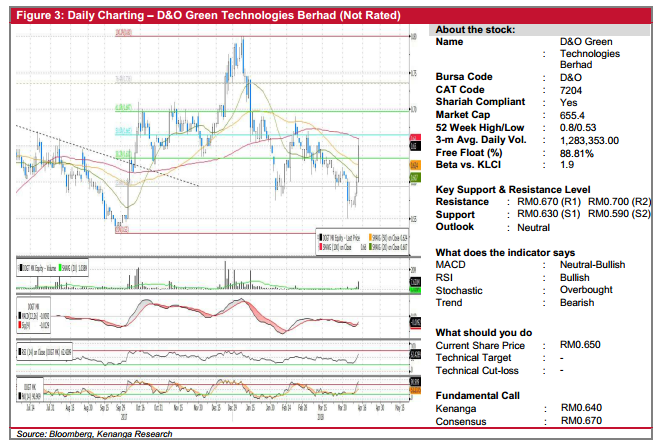

D&O (Not Rated)

- D&O jumped 5.0 sen (8.33%) yesterday to close at RM0.650.

- Yesterday’s move was backed by strong trading volumes and the long-white candlestick formed over the past three trading days indicate that the bulls were in firm control.

- Despite the share being on a downtrend since January 2018, the recent uptick seen in the MACD line indicates that there might be a possibility of a positive shift in momentum.

- Continuous positive momentum and buying interest may see it head towards RM0.670 (R1) and possibly RM0.700 (R2).

- Unsustainable positive momentum will see supports at RM0.630 (S1) and RM0.590 (S2).

AEON (Not Rated)

- AEON advanced 6.0 sen to RM2.06 (+3.0%) yesterday, accompanied by trading volume of 3.8m – above average volume of 1.6m.

- Technical outlook appears positively biased. The recent formation of bullish “Flag” pattern indicates the continuation of its uptrend ever since bottoming-out late-Feb. Meanwhile, key SMAs are in “Golden Cross” state, while momentum indicators also remain in the positive territory.

- The share appears to be in the midst of challenging its resistance at RM2.08 (R1). Should the buying interest follow through from here, the price may advance towards RM2.24 (R2) further up. Conversely, strong supports lie at RM1.75 (S1) and RM1.45 (S2).

Source: Kenanga Research - 13 Apr 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

AEON2024-11-26

AEON2024-11-26

D&O2024-11-26

D&O2024-11-25

AEON2024-11-25

AEON2024-11-25

AEON2024-11-25

AEON2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

AEON2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-21

D&O2024-11-21

D&O2024-11-20

AEON2024-11-20

D&O2024-11-20

D&O2024-11-19

AEON2024-11-19

D&O2024-11-18

D&O2024-11-18

D&O2024-11-18

D&O2024-11-15

AEONMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments