Kenanga Research & Investment

Daily Technical Highlights – (PARKSON, MPI)

kiasutrader

Publish date: Wed, 23 May 2018, 09:15 AM

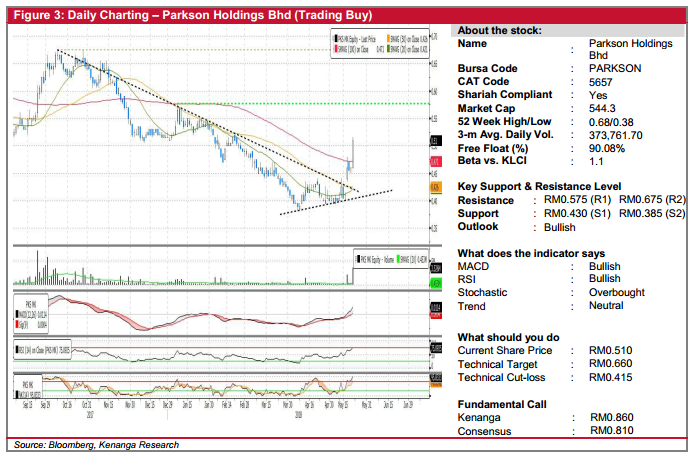

PARKSON (Trading Buy, TP: RM0.660; SL: RM0.415).

- PARKSON jumped 5.0 sen (10.9%) to close at RM0.510 yesterday, accompanied by exceptionally strong trading volume of 3.5m shares.

- Chart-wise, yesterday’s bullish move decisively punched through its previous downtrend line, with recent lows forming a support trend line. We believe these marks as important signals for a likely trend reversal.

- Additionally, momentum indicators are bullish with a MACD crossover, coupled with uptrend in the RSI.

- From here, expect follow through buying towards resistances at RM0.575 (R1) and RM0.675 (R2).

- Conversely, supports can be identified at RM0.430 (S1) and RM0.385 (S2).

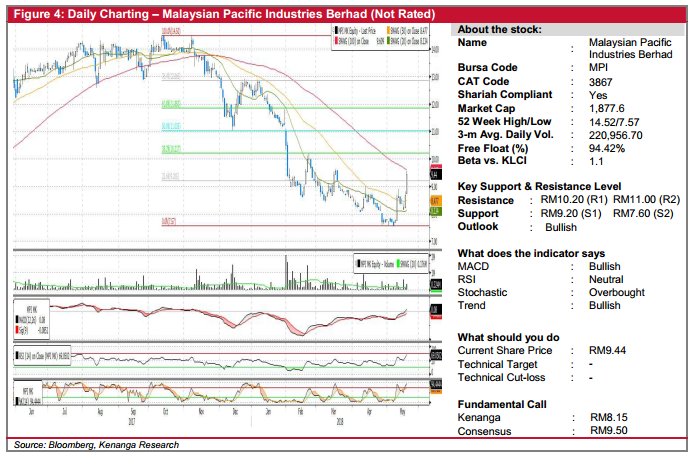

MPI (Not Rated)

- MPI climbed 78.0sen (9.01%) to reach RM9.44, riding on higher-than-average trading volume.

- The share was on a downtrend since early November 2017, hitting a low of RM7.60 in early May 2018.

- The formation of a long white candlestick and breaking out of the RM9.20 resistance level may suggest that MPI has already bottomed-out from its downtrend.

- Momentum indicators are showing strong display with the share breaking above both the 20 and 50-day SMAs.

- Expect follow-through buying from here that may see the counter head towards RM10.20 (R1) and possibly RM11.00 (R2) over the next few days.

- Supports, on the other hand, can be identified at resistance-turned-support of RM9.20 (S1) and RM7.60 (S2) further below.

Source: Kenanga Research - 23 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments