Kenanga Research & Investment

Daily Technical Highlights - (N2N, CCM)

kiasutrader

Publish date: Wed, 13 Jun 2018, 09:05 AM

N2N (Not Rated)

- N2N climbed 8.0 sen (+6.84%) to close at RM1.25 on higher than average trading volume.

- Chart-wise, the share had been rallying since the start of April, with a break above the RM1.14 resistance level last week further confirming the uptrend.

- Technical indicators are still bullish and yesterday's candlestick may indicate that buying momentum is still strong.

- From here, it is expected that follow-through buying to bring the share to test resistances at RM1.34 (R1) and RM1.40 (R2).

- Meanwhile, any downside bias will see support at RM1.14 (S1) and RM1.02 (S2) further below.

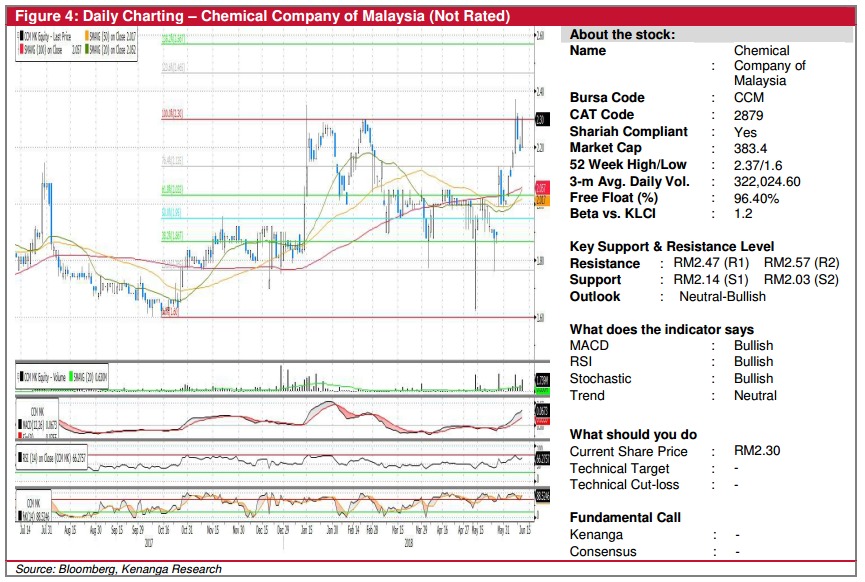

CCM (Not Rated)

- CCM jumped 11.0 sen (+5.0%) to RM2.30 yesterday, accompanied by 1.7m traded volume - triple its 20-day average volume of 0.6m shares

- Overall technical outlook is positively biased as reflected by up trending displays of MACD and RSI.

- From here, the share could possibly test resistances at RM2.47 (R1) and RM2.57 (R2).

- Conversely, downside support levels can be identified at low of RM2.14 (S1) and RM2.03 (S2).

Source: Kenanga Research - 13 Jun 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments