Kenanga Research & Investment

Daily Technical Highlights – (KPS, LEESK)

kiasutrader

Publish date: Thu, 05 Jul 2018, 09:18 AM

KPS (Not Rated)

- KPS gained 9 sen yesterday (+4.81%), accompanied by above-average trading volume to close at RM1.96.

- Chart-wise, the stock has been on a rally after it broke out of a descending wedge pattern since mid-May. However, we think that the stock is overextended, given its steep rally and that a retracement is likely to happen soon.

- Both the RSI and Stochastic are currently at overbought levels and the stock may seems possible of eventually retesting RM2.29 (R1) based on Fibonacci projection.

- Keen investors can time their entries at support levels of RM1.75 (S1) and RM1.58 (S2).

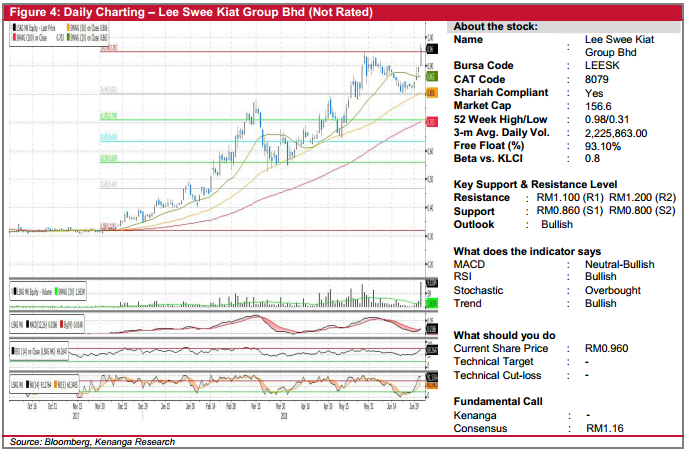

LEESK (Not Rated)

- Yesterday, LEESK jumped 6.5 sen (+7.26%) to mark a record close of RM0.960 under the support of exceptional trading volume.

- In addition to the positive resistance breakout, display of a long-white-bodied candlestick further substantiates the bullishness towards the stock.

- Overall, the underlying uptrend of LEESK remains intact with key SMAs and momentum indicators continue strong positive displays.

- From here, follow through buying could pave the price towards resistances at RM1.10 (R1) and RM1.20 (R2). Conversely, supports are identified at RM0.860 (S1) and RM0.800 (S2).

Source: Kenanga Research - 5 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments