Kenanga Research & Investment

Daily Technical Highlights – (FRONTKN, UCHITEC)

kiasutrader

Publish date: Thu, 23 Aug 2018, 09:24 AM

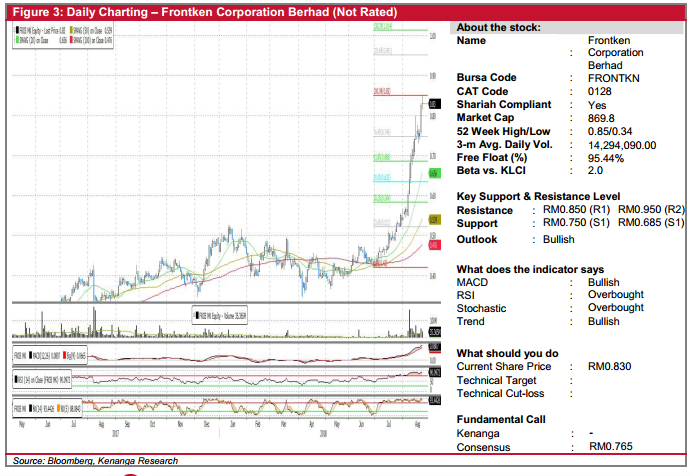

FRONTKN (Not Rated)

- On Tuesday, FRONTKN gained 0.5 sen (+0.61%) to close at RM0.830.

- Chart-wise, the share has been enjoying a super rally since late-July. However, we think that the rally could be overextended and a retracement is likely to happen soon. Notably, Tuesday’s candlestick formed a “Long-Legged Doji” signaling a potential shift in sentiment.

- Momentum indicators such as RSI and stochastic have been hovering in the overbought territory since July, further suggesting the likelihood of a retracement

- We expect to see a healthy correction of the share price to RM0.750 (S1) and further to RM0.685 (S2) should the first support level be broken.

- Conversely, should the rally continue, Fibonacci projected resistances are seen at RM0.850 (R1) and RM0.950 (R2).

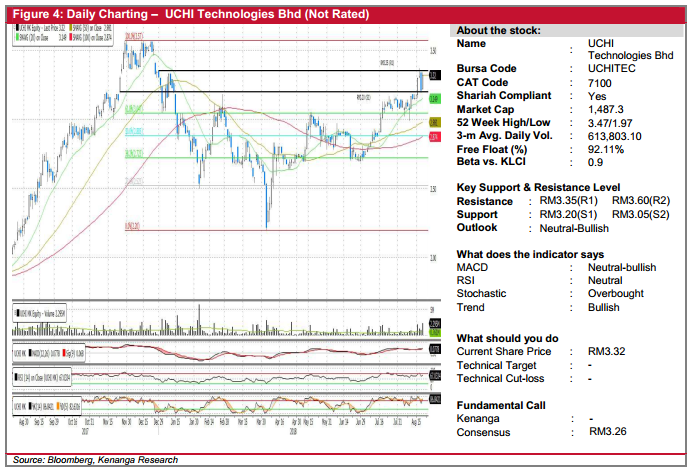

UCHITEC (Not Rated)

- UCHITEC gained 11.0 sen (+3.74%) to close at RM3.32 on Tuesday’s closing, backed by exceptional trading volume.

- Overall, its trend line has been positive, with the share continuously leading key SMAs upwards since it had bottomed–out in early-April.

- Meanwhile, key SMAs remains in a “Golden Crossover” state with momentum indicators also appear in supportive towards the upside.

- From here, expect the share to advance towards RM3.35 (R1) with a decisive breakthrough will see the share on a clear path towards RM3.60 (R2).

- Conversely, downside risks are identified at the immediate support level RM3.20 (S1) with the next support level found at RM 3.05 (S2).

Source: Kenanga Research - 23 Aug 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments