Kenanga Research & Investment

Daily Technical Highlights – (MYEG, MEXTER)

kiasutrader

Publish date: Thu, 06 Sep 2018, 08:50 AM

MYEG (Not Rated)

- MYEG gained 5.0 sen (+3.15%) to close at RM1.64.

- The share had been riding on a bullish run over the past two weeks, accompanied by strong trading volumes.

- However, yesterday’s candlestick resembles a ‘Shooting Star’ and may signal a bearish reversal.

- We do not discount a possibility of a retracement towards its support levels at RM1.46 (S1) and even RM1.15 (S2).

- Should the rally continue, resistance is seen at RM1.70 (R1) and RM1.95 (R2).

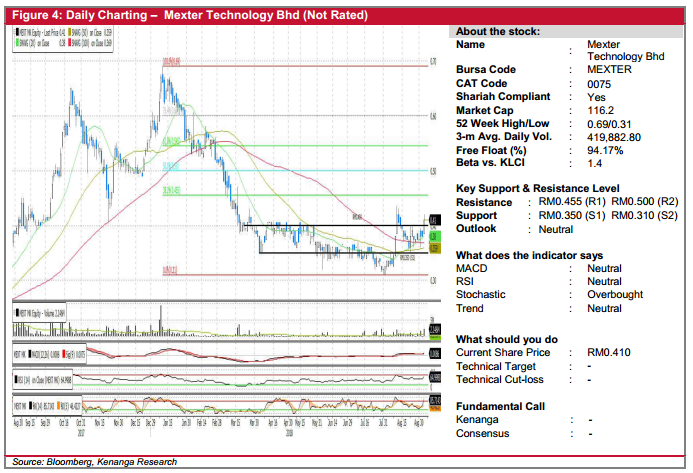

MEXTER (Not Rated)

- MEXTER gained 3.0 sen (+7.89%) to close higher at RM0.410 underpinned by stronger-than average trading volume.

- Technical outlook is mildly positive at this juncture backed by momentum indicators still displaying some weaknesses as indicated by the flat-lining of the MACD with minor upticks seen in RSI and Stochastic.

- Nevertheless, the share managed to close above all key SMAs which currently in “Golden Crossover” state.

- From here, should the buying momentum be sustained, look out for resistance level at RM0.455 (R1) with a decisive breakout will see the share advancing towards RM0.500 (R2)

- Conversely, support levels are identified at RM0.350 (S1) and RM0.310 (S2) further down.

Source: Kenanga Research - 6 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments