Kenanga Research & Investment

Daily Technical Highlights – (KRONO, BAHVEST)

kiasutrader

Publish date: Thu, 13 Sep 2018, 10:51 AM

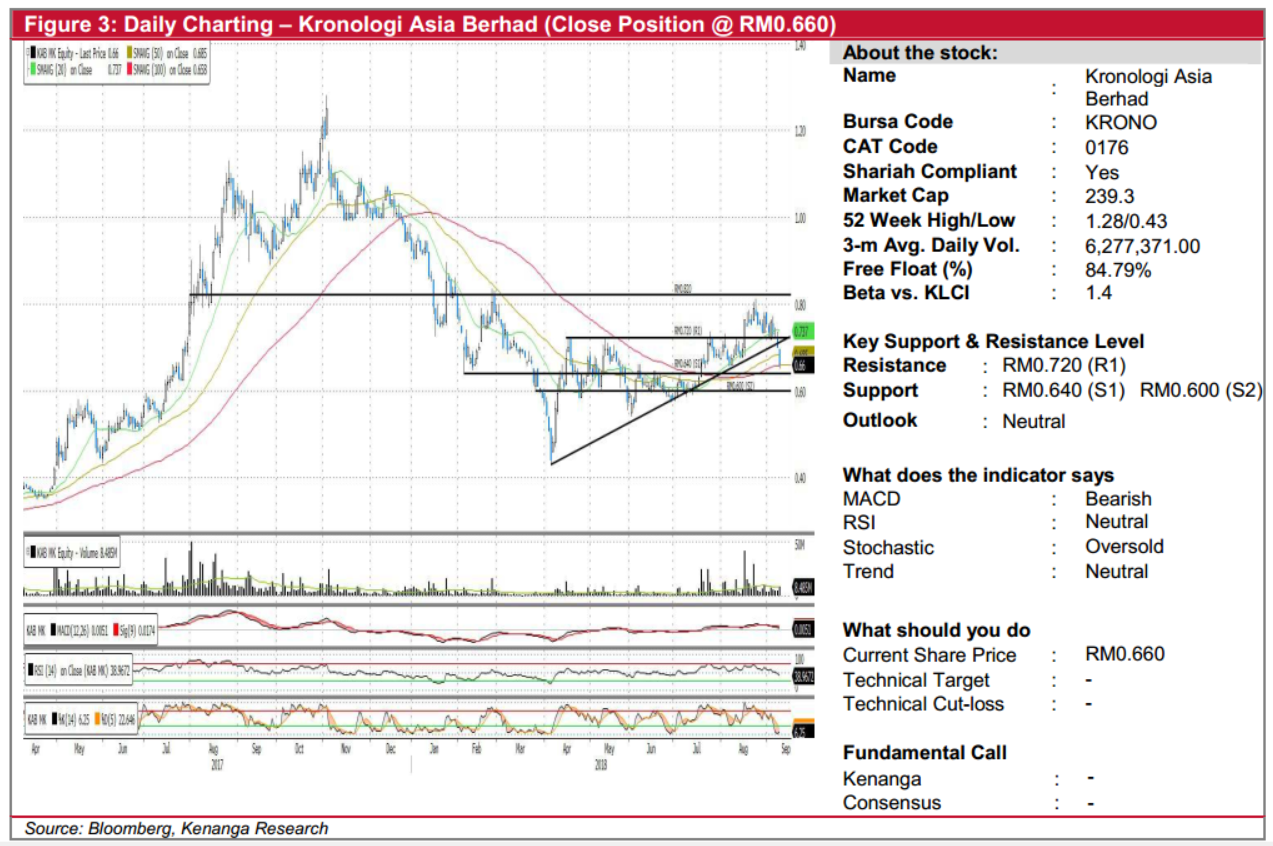

KRONO (Close Position @ RM0.660)

- KRONO fell 4.0 sen (-5.71%) to close at RM0.660 yesterday.

- Since our ‘Trading Buy’ call earlier this August, the share rallied to a high of RM0.810. However, it failed to break above its resistance of RM0.820 and saw a gradual decline thereafter.

- Key momentum indicators such as the MACD and RSI are showing negative signals, indicating a loss of momentum with the share price breaking below its ascending triangle formation decisively.

- We decide to close position for now. Traders can consider selling on any near-term strength towards RM0.720 (R1).

- Conversely immediate support levels are RM0.640 (S1) and further down at RM0.600 (S2).

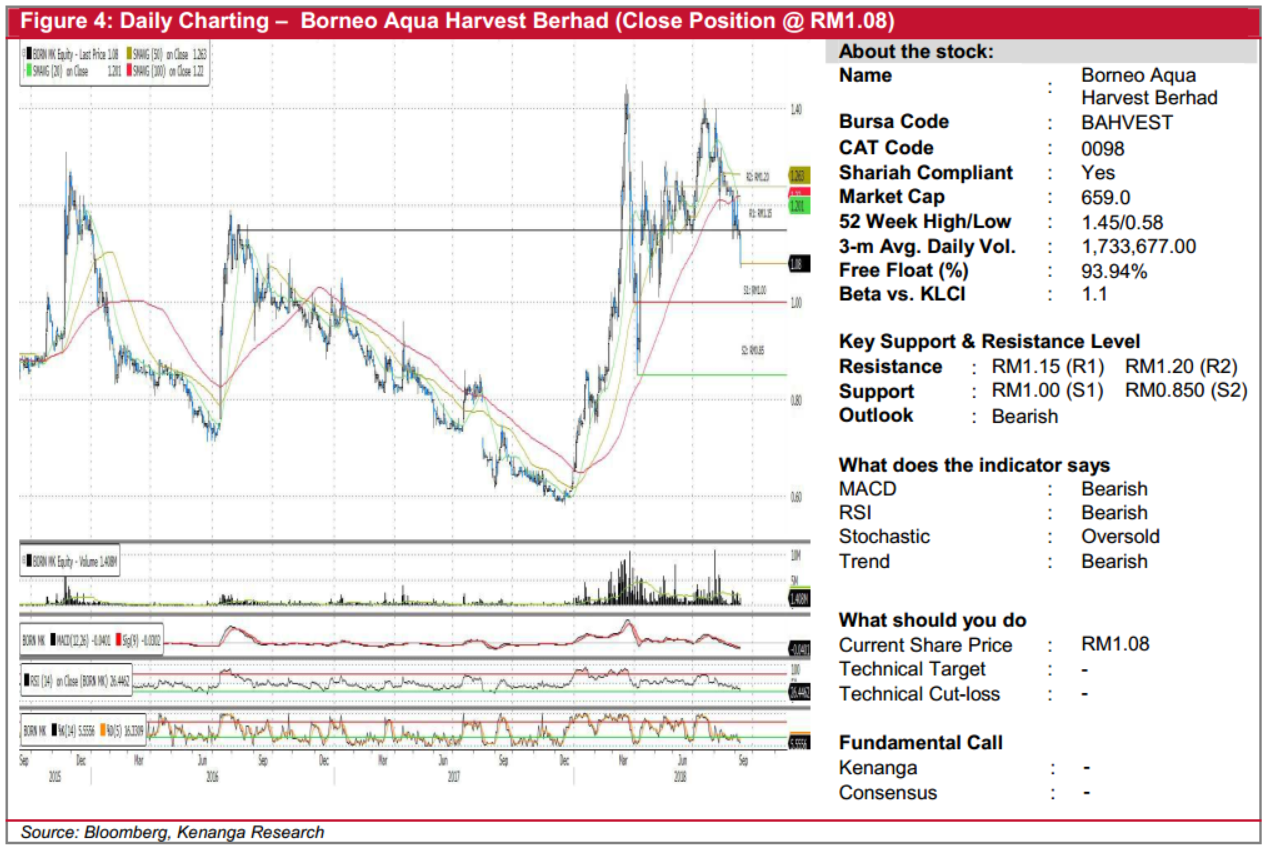

BAHVEST (Close Position @ RM1.08)

- Following our “Trading Buy” call on BAHVEST in July 2018, the share rallied for a short moment and attempted to break past the RM1.40 resistance level.

- However, the bullish run was not sustained as the share quickly went into a downtrend.

- Overall technical picture is looking bearish with all key technical indicators in negative mode. More notably, the 100-day SMA had recently crossed above the 20-day SMA.

- Thus, we choose to close position for now. Traders could sell on strength towards the RM1.15 (R1) or even RM1.20 (R2). Conversely, we may position for a re-entry if it falls further to the RM1.00 (S1) and RM0.850 (S2) levels.

Source: Kenanga Research - 13 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments