Kenanga Research & Investment

Daily Technical Highlights – (MYEG, EFORCE)

kiasutrader

Publish date: Thu, 20 Sep 2018, 09:17 AM

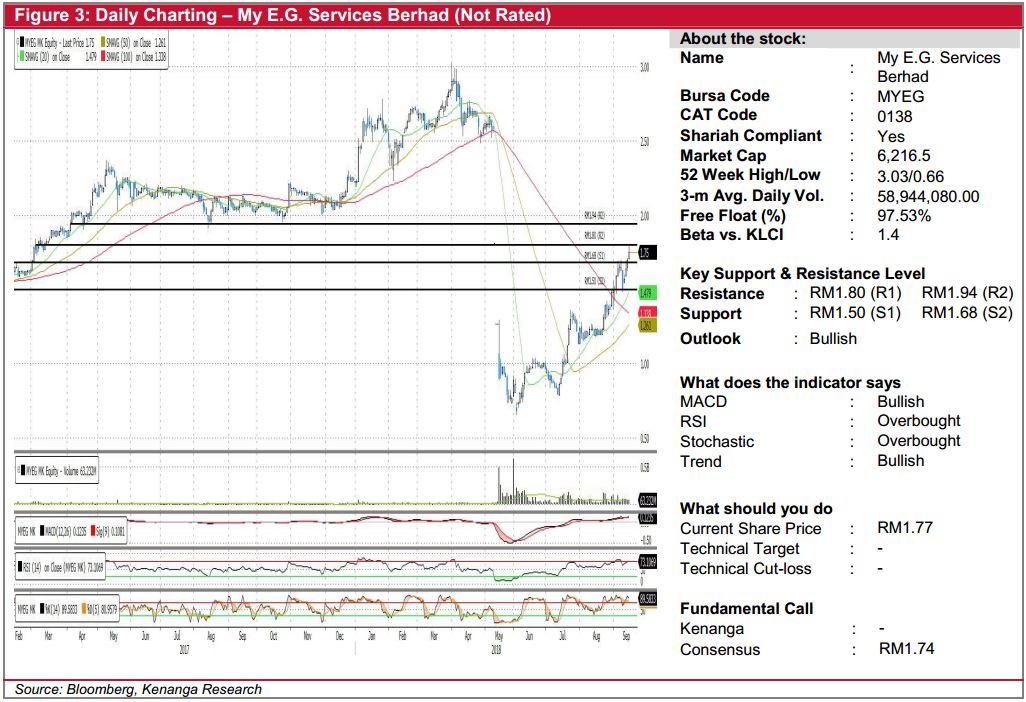

MYEG (Not Rated)

- MYEG climbed 5.0 sen (+2.94%) to end at RM1.75 last night.

- Technically, the share has been on a rally since bottoming-out in June. More notably, yesterday’s candlestick represented a convincing break above its previous swing high of RM1.70, which could be an indication of a continuation of its rally.

- Key SMAs and momentum indicators continue to show positive signals further reaffirming the potential of a continuation rally.

- We look towards RM1.80 (R1) and RM1.94 (R2) as levels of resistance. Conversely, downside supports can be identified at RM1.68 (S1) and RM1.50 (S2) where keen investors may want to watch to build a position.

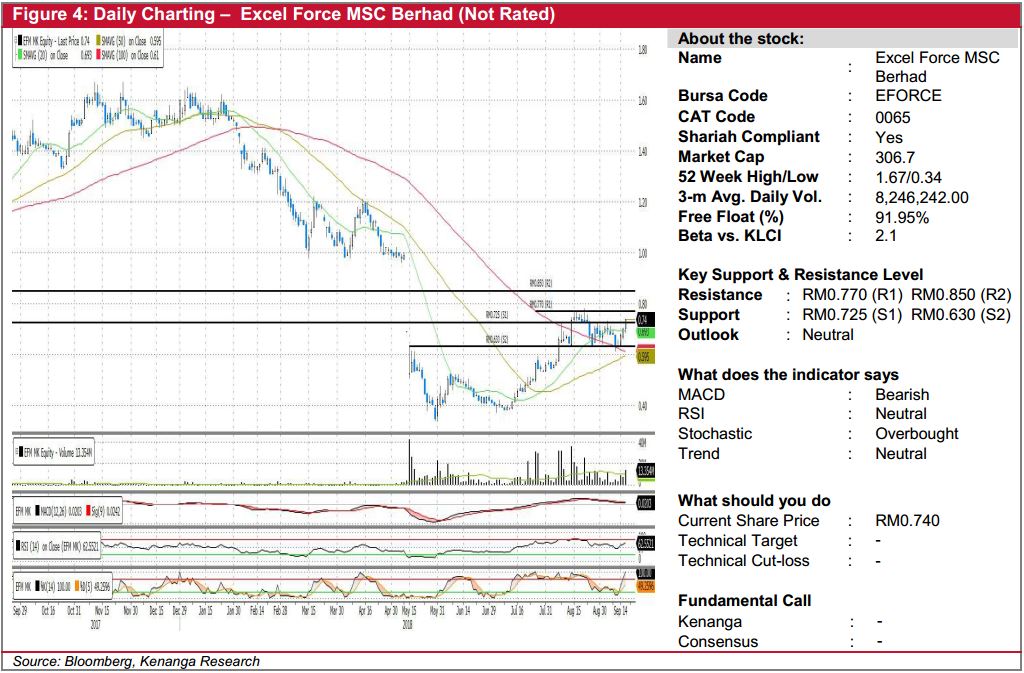

EFORCE (Not Rated)

- Yesterday, EFORCE gained 4.0 sen (+5.71%) to close at RM0.740.

- Chart-wise, the share has been moving up North after seemingly bottoming out in late-May. Yesterday’s move represented a decisive close above its 20-day SMA indicating that the trend is still intact.

- The RSI remains in the neutral zone indicating further upside potential.

- From here, we expect continuous buying towards RM 0.770 (R1) and RM0.850 (R2) should the first level be taken out.

- Conversely, retracement towards RM0.725 (S1) and RM0.630 (S2) would serve as a good entry point for interested investors.

Source: Kenanga Research - 20 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments