Kenanga Research & Investment

Daily Technical Highlights – (D&O, PARKSON)

kiasutrader

Publish date: Fri, 21 Sep 2018, 09:30 AM

D&O (Not Rated)

- Yesterday, D&O hit a record intraday high of RM0.830 before closing at RM0.815 on the back of exceptional trading volume of 71m shares traded - 18x its 20-day average.

- Technically, the share has been undergoing a mild uptrend over the past several months, with yesterday’s move seeing it decisively punching through its prior overhead resistance at RM0.785-0.800.

- With its underlying uptrend still strongly intact, coupled with positive displays from key indicators, we expect follow-through momentum to bring the share price towards resistances at RM0.840 (R1) and RM0.875 (R2).

- Conversely, supports at RM0.785 (S1) and RM0.730 (S2) could potentially act as buying opportunities.

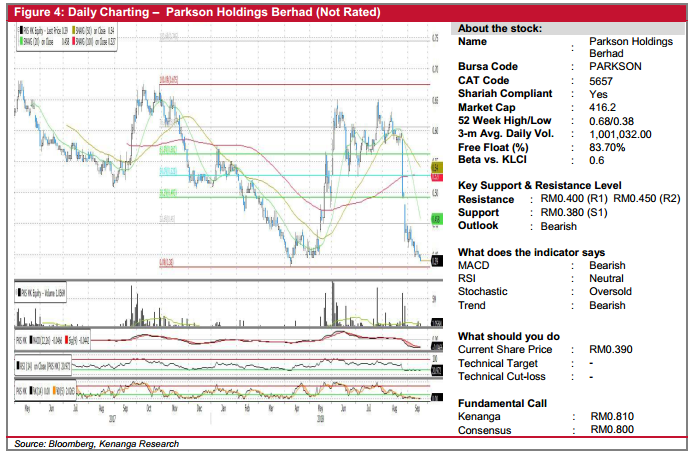

PARKSON (Close Position @ RM0.390)

- We bring closure to our "Trading Buy" recommendation on PARKSON amid on-going rationalisation of our technical portfolio.

- We first recommended PARKSON on the 23 May 2018 and it had rallied to a high of RM0.650 (+27.5%) before plunging heavily following the announcement of PARKSON Retail Asia’s 4Q18 net loss.

- More recently this month, the stock broke below its psychological support level at RM0.400 and capitulated to yesterday's closing price of RM0.390 (-1.27%).

- We reckon the technical outlook is highly bearish with trading volumes tapering and negative MACD continuing its downward movement.

- From here, support level identified at RM0.380 (S1) while resistances levels are found at support-turned-resistance RM0.400 (R1) and RM0.450 (R2) next.

Source: Kenanga Research - 21 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

D&O2024-11-26

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-25

D&O2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-22

D&O2024-11-21

D&O2024-11-21

D&O2024-11-20

D&O2024-11-20

D&O2024-11-19

D&O2024-11-18

D&O2024-11-18

D&OMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments