Kenanga Research & Investment

Daily Technical Highlights – (AEON, AWC)

kiasutrader

Publish date: Fri, 28 Sep 2018, 09:28 AM

AEON (Trading Buy, TP: RM1.95; SL: RM1.62)

- AEON fell 7.0 sen (-3.87%) to close at RM1.74 yesterday.

- Chart-wise, AEON has been declining after breaking below its 100-day SMA in late-August. We believe that the sell-down is overdone, and that price should be rebound soon given that the RSI indicator has been hovering around the oversold zone. More notably, there is a bullish divergence between the RSI indicator and AEON’s share price further suggesting the possibility of a rebound.

- We expect buying momentum to pick up to bring the share price towards resistances of RM1.85 (R1) and RM1.98 (R2).

- Conversely, immediate supports can be identified at RM1.73 (S1) and RM1.65 (S2).

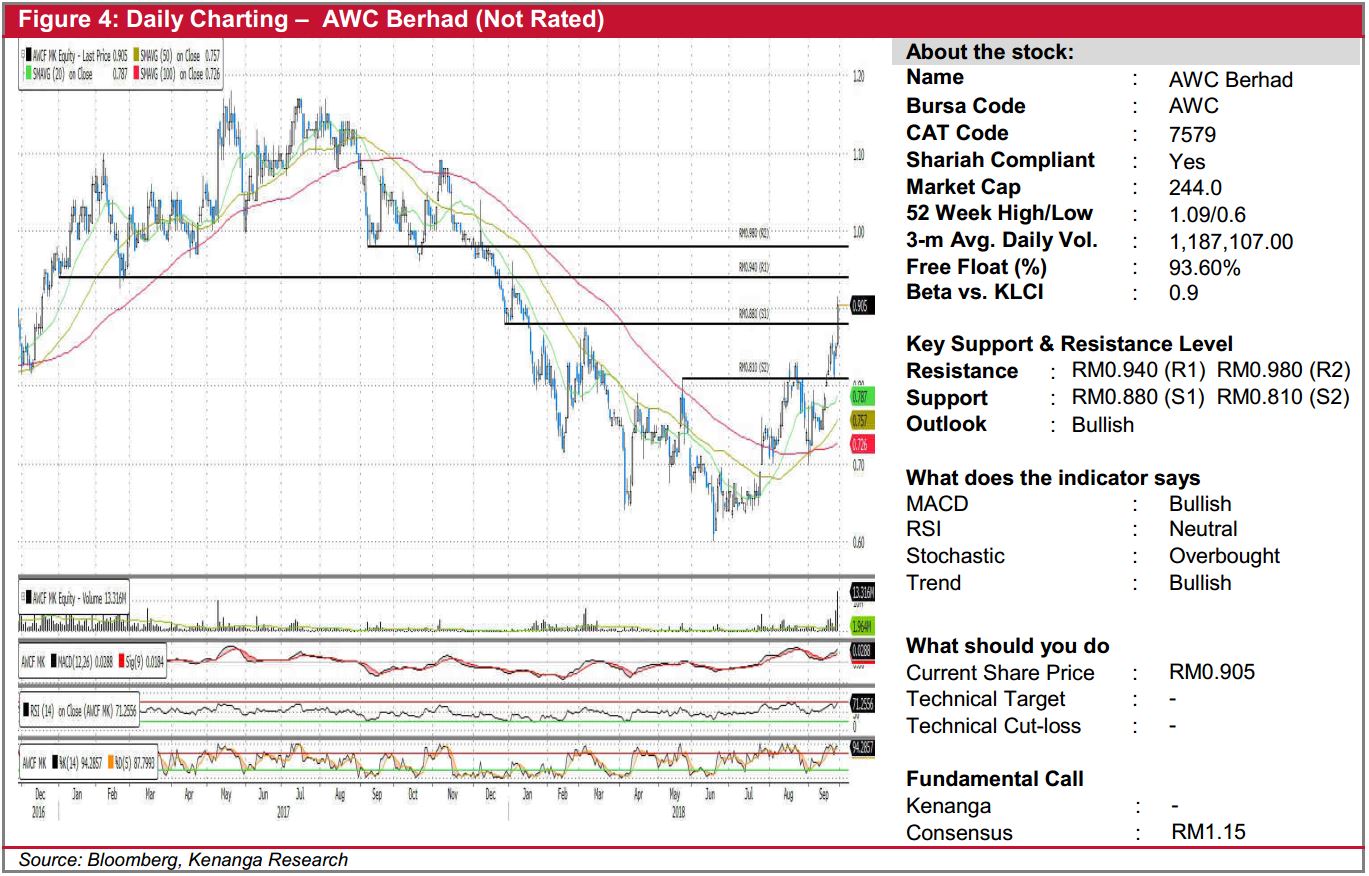

AWC (Not Rated)

- AWC rose 5.5 sen (+6.47%) to close at RM0.905, on the back of exceptional trading volume.

- Yesterday’s candlestick represented a convincing break above its 2018-high of RM0.875. This, accompanied by volume and positive signals from momentum indicators indicates a potential continuation of its rally.

- Key resistances to look out for are RM0.940 (R1) and RM0.980 (R2).

- Immediate downside support can be found at the resistance-turned-support level of RM0.880 (S1) and further down at RM0.810 (S2), where keen investors may want to keep an eye on to take on a position.

Source: Kenanga Research - 28 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments