Kenanga Research & Investment

Daily Technical Highlights – (BARAKAH, CCM)

kiasutrader

Publish date: Tue, 02 Oct 2018, 09:23 AM

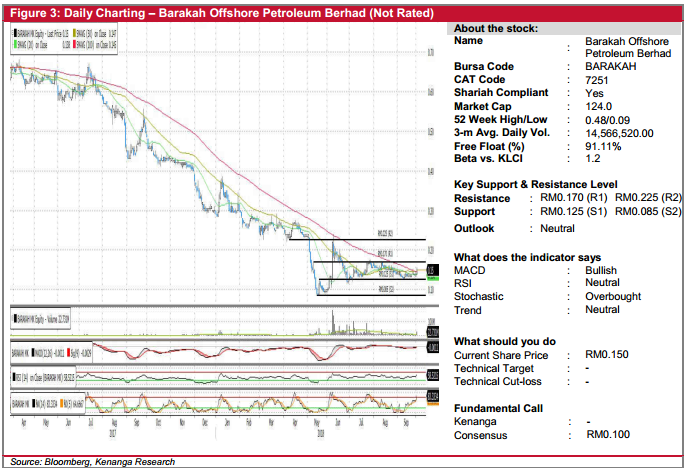

BARAKAH (Not Rated)

- BARAKAH gained 1.0 sen (+7.14%) to close at RM0.150 yesterday on the back of above-average trading volume.

- More notably, yesterday’s move represented a close above the 100-day SMA, a first since July 2017, which could indicate a potential reversal. Key momentum indicators are also displaying positive signals.

- Should buying momentum continue; we look towards RM0.170 (R1) as the first resistance level and further to RM0.225 (R2) as the next.

- Conversely, supports can be identified at RM0.125 (S1) and RM0.085 (S2).

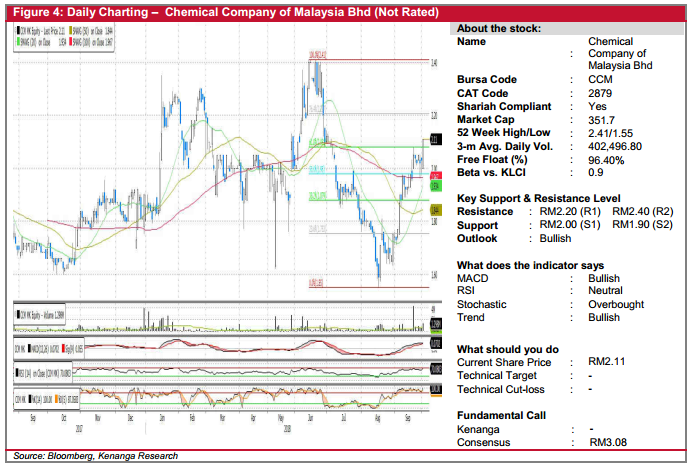

CCM (Not Rated)

- CCM rose 8.0 sen (+3.94%) to close at RM2.11, with 1.3m shares exchanging hand - double its 20-day average.

- Technically, the share has been enjoying a steady uptrend since mid-August, with yesterday’s close resulting in a formation of a bullish Marubozu candlestick and a decisive breakout above its prior RM2.10 resistance level.

- Momentum indicators appear supportive of a positive outlook as showcased by the MACD bullish convergence with minor upticks seen in RSI and Stochastic.

- Key resistance to look out for in the near-term is RM2.20 (R1) with the next leg of "higher high" towards resistance level RM2.40 (R2).

- Downside supports can be found at RM2.00 (S1) and RM1.90 (S2) further down.

Source: Kenanga Research - 2 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments