Kenanga Research & Investment

Daily Technical Highlights – (MYEG, MEXTER)

kiasutrader

Publish date: Tue, 09 Oct 2018, 12:40 PM

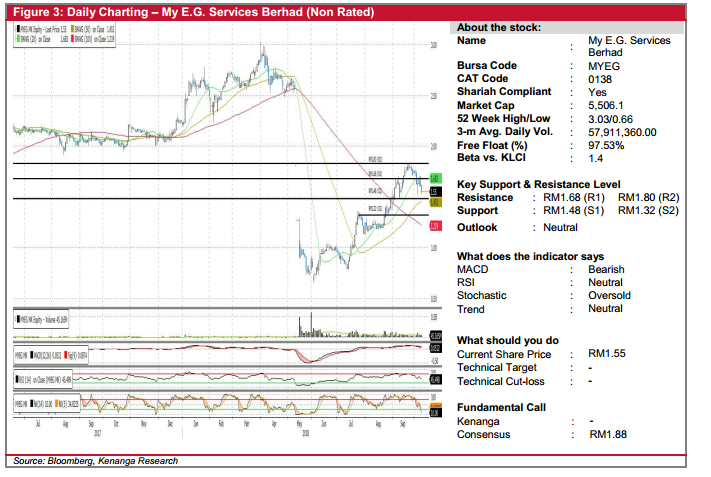

MYEG (Not Rated)

- MYEG fell 6.0 sen (-3.73%) to close at RM1.55 yesterday.

- Chart-wise, the share seems to be undergoing a correction since its remarkable July rally. We observed that its previous resistance turned support of RM1.48, near its 50-day SMA has been a reasonably sturdy support.

- As such, we expect a rebound to happen around the 50-day SMA. While stochastic has entered the oversold territory, we note that RSI tends to remain around the mid-range during a correction of a rally which paints the picture of potential buying interest.

- We look towards RM1.68 (R1) and RM1.80 (R2) as resistances. Conversely, immediate support can be identified at RM1.48 (S1), near the 50-day SMA and further down at RM1.32 (S2).

MEXTER (Not Rated)

- MEXTER rose 1.0 sen (+2.38%) to close at RM0.430, backed by stronger-than-average trading volume.

- Yesterday’s close saw MEXTER decisively breaking above the RM0.420 prior resistance level, resulting in a formation of a long bullish candlestick.

- Technical picture is increasingly positive with the share remaining above all key SMAs, which are also in “golden cross” state.

- Overhead key resistance can be identified at RM0.470 (R1) and further ahead at RM0.520 (R2).

- Conversely, support levels can be found at an immediate support level of RM0.420 (S1) and RM0.380 (S2).

Source: Kenanga Research - 9 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments