Daily technical highlights – (GAMUDA, SANICHI)

kiasutrader

Publish date: Tue, 16 Oct 2018, 08:50 AM

GAMUDA (Trading Buy, TP: RM3.00; SL: RM2.00)

• GAMUDA gained 7.0 sen (+2.98%) to close at RM2.42 on strong trading volume.

• Since the announcement by the government to terminate GAMUDA-MMCCORP JV for the MRT2 tunnelling works, the stock plunged to a low of RM2.07.

• However, the past three-days have seen the share rebound. We believe the share is still in the initial stage of rebounding. Both stochastic and RSI indicators have just left the oversold territory further suggesting more upside.

• From here, we expect continuous buying momentum that may see the share test its immediate resistance at RM2.50 (R1) while a break above R1 will see RM2.75 (R2) as the next resistance.

• Conversely, any downside bias will see support at RM2.00 (S1) where interested investors can collect while a break below RM1.90 (S2) is deemed highly negative.

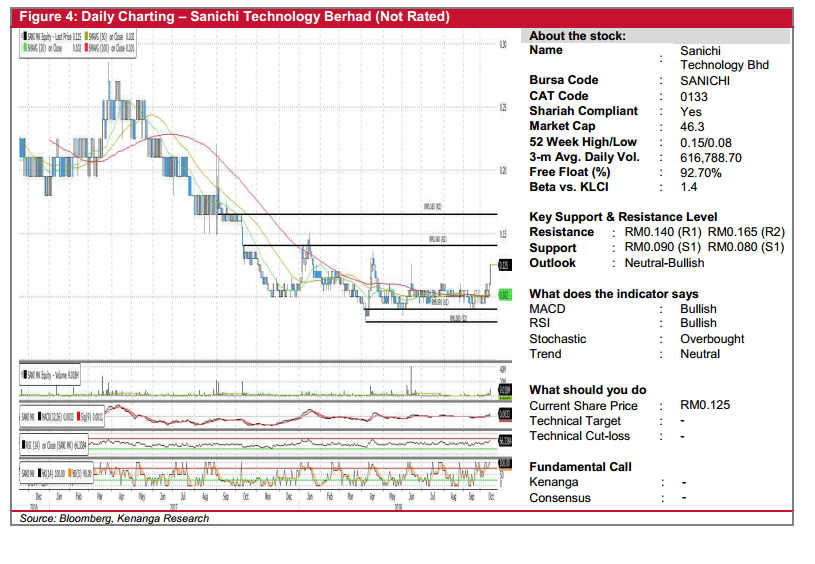

SANICHI (Not Rated)

• SANICHI gained 1.5 sen (13.64%) to close at RM0.125 yesterday, backed by explosive trading volume with 9.0m shares exchanging hand – a 6-folds to its 20-day average.

• Notably, yesterday’s close marked a decisive breakout from its 5-month consolidation mode of RM0.090-RM0.110 after multiple retests in the days prior.

• Given MACD continuing bullish uptrend with other momentum indicators displaying positive readings, expect SANICHI to further trend towards RM0.140 (R1) with a decisive breakthrough will see the share on a clear path towards RM0.165 (R2).

• Conversely, should the buying momentum fail to sustain, expect an immediate support level at RM0.090 (S1) and RM0.080 (S2).

Source: Kenanga Research - 16 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

GAMUDA2024-11-26

GAMUDA2024-11-26

GAMUDA2024-11-26

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-25

GAMUDA2024-11-23

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-22

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-21

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-20

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-19

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA2024-11-18

GAMUDA