Kenanga Research & Investment

Daily Technical Highlights – (NGGB, EDGENTA)

kiasutrader

Publish date: Wed, 17 Oct 2018, 08:41 AM

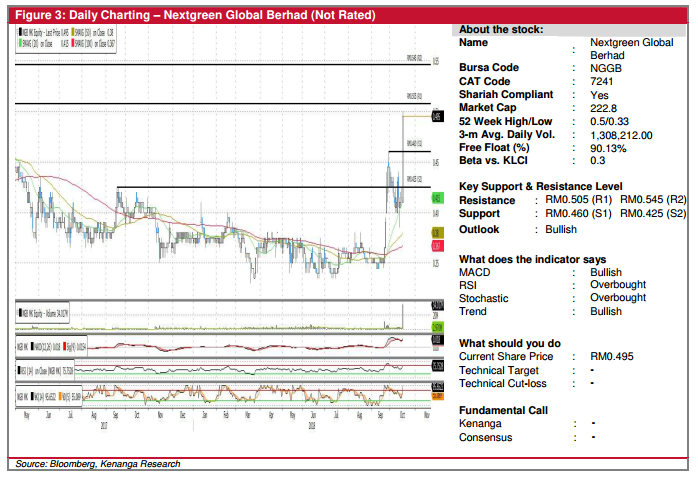

NGGB (Not Rated)

- NGGB gained 8.0 sen (+19.28%) yesterday to close at RM0.495 on the back of exceptional trading volume, as it secured a RM400m investment from Asia Capital Investment Fund to finance its Green Technology Park projects in Malaysia.

- Chart-wise, NGGB rallied mid-Sept and was consolidating near its 20-day SMA before yesterday’s move. Yesterday’s move represented a break above its previous swing high of RM0.460 signalling a potential continuation of its September rally.

- Key momentum indicators continue to show meaningful upticks. Coupled with the bullish crossover signal from the MACD indicator, this increases the possibility of a continuation rally.

- From here, we expect continuous buying momentum to bring the share towards resistances at RM0.505 (R1) and RM0.545, should the first level be taken out.

- Conversely, any downside bias should see supports at RM0.460 (S1) and RM0.425 (S2).

EDGENTA (Not Rated)

- EDGENTA gained 10.0 sen (3.85%) to close at RM2.70 yesterday, accompanied by exceptional trading volume with 2.2m shares exchanging hand – almost 4-folds to its 20-day average.

- Yesterday’s candlestick marked the share closing above key SMAs which currently are in a “Golden Cross” state.

- Overall trend line is positive while momentum indicators are also displaying positive showings.

- From here, we expect EDGENTA to make the next high towards RM2.82 (R1). Should follow-through buying momentum sustain, further possible advancement could then be expected at RM3.29 (R2).

- Downside support can be found at the immediate support level at RM2.54 (S1) and RM2.43 (S2) further down.

Source: Kenanga Research - 17 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments