Kenanga Research & Investment

Daily Technical Highlights – (INARI, DUFU)

kiasutrader

Publish date: Tue, 30 Oct 2018, 12:16 PM

INARI (Trading Buy, TP: RM2.17; SL: RM1.61)

- INARI fell 10.0 sen (-5.26%) to close at RM1.80 yesterday.

- Chart-wise, INARI has experienced a steep sell-down over the past few trading days. However, we believe the sell-down could be overdone due to its sharper-than-expected correction, thus, prompting the possibility of rebound.

- Key momentum indicators such as RSI and stochastic are in oversold conditions and price is hovering around a key Fibonacci retracement level. We also note that oversold conditions on the RSI for INARI seldom occurs, which further strengthens the case of a rebound.

- We look towards RM1.99 (R1) and RM2.20 (R2) as resistances while any further downside bias should see support at RM1.64 (S1) where keen investors may look at to build a position.

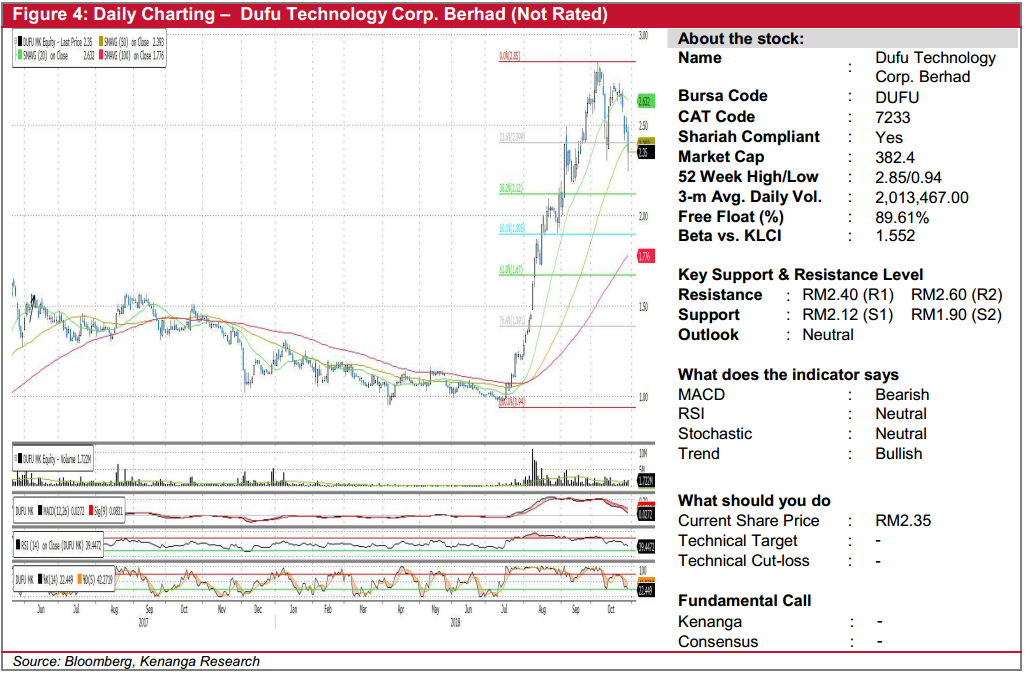

DUFU (Not Rated)

- Yesterday, DUFU declined 11.0 sen (-4.47%) to close at RM2.35.

- Technical-wise, DUFU has enjoyed a remarkable rally since mid-July and is currently experiencing a retracement. We believe the retracement is not over yet given fewer exciting signals from key momentum indicators. We also note the possibility of a head and shoulders pattern in the making giving more hints of further downside.

- From here, immediate support levels can be identified at RM2.12 (S1) and RM1.90 (S2) which are both key Fibonacci levels.

- Conversely, should the buying momentum continue we look at RM2.40 (R1) and RM2.60 (R2), close to its 20-day SMA as resistances.

Source: Kenanga Research - 30 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments