Daily technical highlights – (DAYANG, MEDIA)

kiasutrader

Publish date: Fri, 09 Nov 2018, 10:00 AM

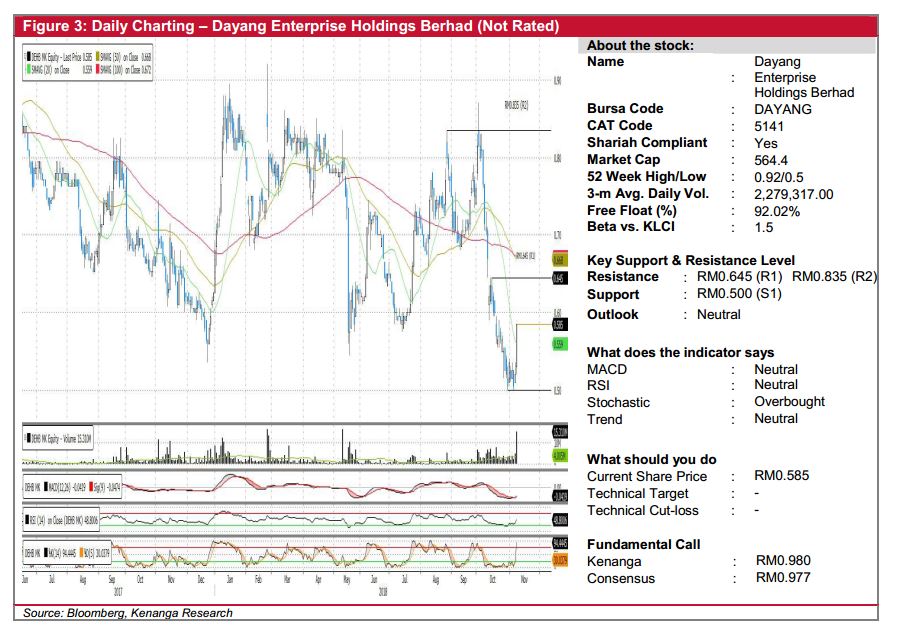

DAYANG (Not Rated)

• Yesterday, DAYANG jumped 6.5 sen (+12.5%) to close at RM0.585, backed by exceptional trading volume with 15.3m shares exchanging hands – nearly 4-folds its daily average.

• Chart-wise, the share has been suffering from a severe sell-down since early last month. However, the share may now be in the midst of a technical rebound after retesting the RM0.50 (S1) for a second time earlier this week, underpinned by the resurgence of a bullish MACD-crossover coupled with the growing trading volumes.

• From here, we reckon the share may retest key resistances at RM0.645 (R1) and RM0.835 (R2).

• Conversely, the downside should be fairly limited, with the aforementioned S1 support to pose as a resilient support.

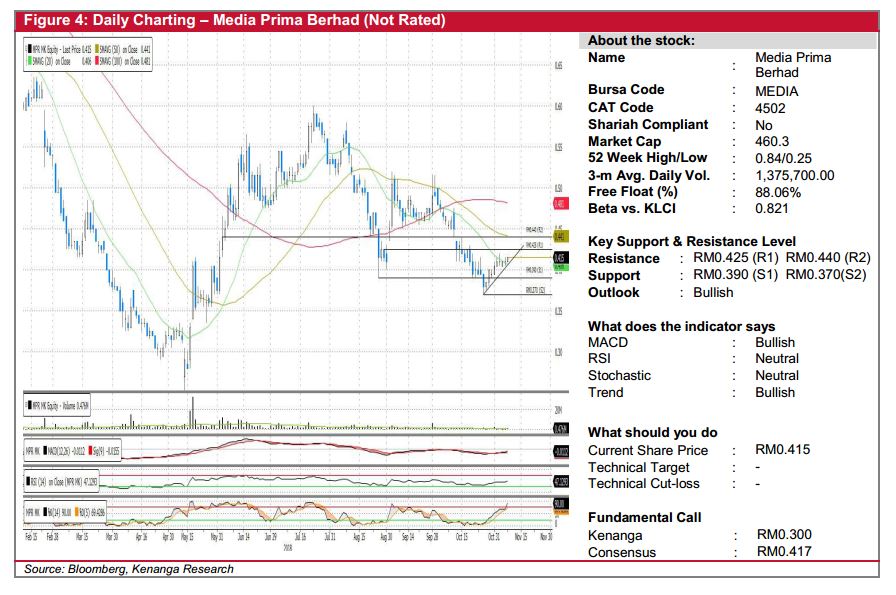

MEDIA (Not Rated)

• MEDIA made marginal gains of 0.5 sen (+1.22%) to close at RM0.415 yesterday.

• The share was on a downtrend since mid-July. However, recent rally may indicate a possibility of a reversal. More notably, the share had just broken above the 20-day SMA.

• From here, we anticipate it to test its resistance at RM0.425 (R1) where a break above R1 will see next resistance at RM0.440 (R2)

• Meanwhile, downward bias will see supports at RM0.390 (S1) and RM 0.370 (S2).

Source: Kenanga Research - 9 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|