Kenanga Research & Investment

Daily Technical Highlights – (LCTITAN, GCB)

kiasutrader

Publish date: Wed, 21 Nov 2018, 09:11 AM

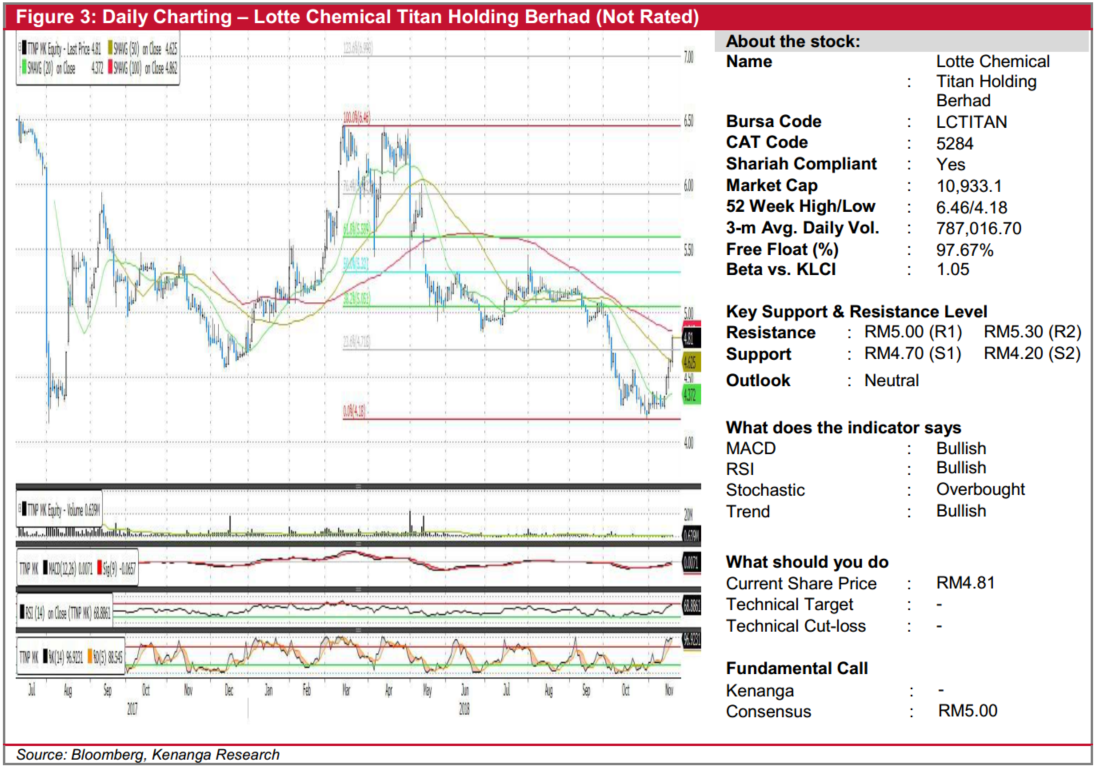

LCTITAN (Not Rated)

- LCTITAN gained 18.0 sen (+3.89%) to end at RM4.81 on Monday.

- The share had been hovering around the RM4.20 support level for a month before seeing strong buying interest that saw the share increase by 12.4% from a week ago.

- Overall technical outlook is positive with the share having just broken above the 50-day SMA while other momentum indicators are displaying bullishness.

- From here, should there be a follow-through in buying momentum, we may see the share testing its resistances at RM5.00 (R1) and RM 5.30 (R2).

- Conversely, downside bias should see supports at RM4.70 (S1) and RM4.20 (S2).

GCB (Not Rated)

- On previous Monday, GCB gained 19.0 sen (+6.64%) to close at RM3.05 on the back of stronger-than-average trading volume.

- Chart-wise, the share has been on an uptrend since April and the share has closed above the psychological resistance level of RM3.00.

- Momentum indicators appear supportive for a bullish move as indicated by the bullish MACD, RSI and Stochastic.

- Should buying momentum be sustained, we look towards RM3.25 (R1) and RM3.45 (R2).

- Conversely immediate support level can be seen at RM2.80 (S1) and further down towards RM2.52 (S2).

Source: Kenanga Research - 21 Nov 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments