KIP REIT - Great Yields On Stable Assets

kiasutrader

Publish date: Thu, 06 Dec 2018, 09:03 AM

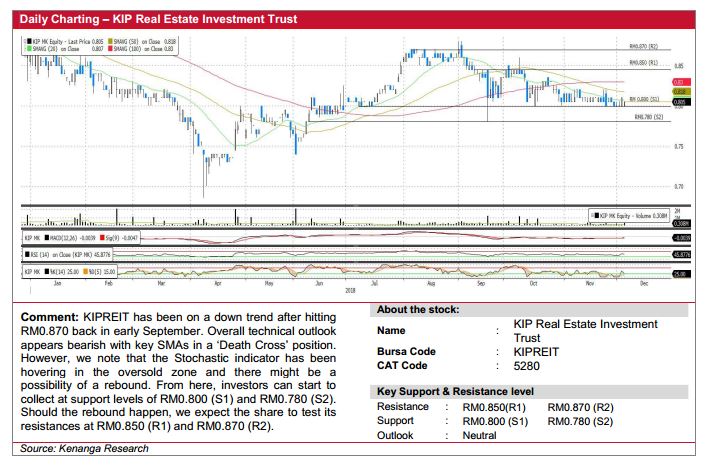

We reiterate our Trading Buy call with a lower Fair Value of RM0.950 (from RM1.05) as we are more conservative on valuations. FY19-20E gross dividend yields of 8.4% each are attractive on minimal earnings downside risk given that most leases expiring in FY19 have been secured. Reversions have been positive at low-single digit, in line with FY19-20E RNI of RM35.8-36.1m. Long-term positive on recent proposed acquisition of AEON Mall Kinta City.

Attractive dividend yields. Share price decline of 7% YTD is in tandem the KLREI index (-13% YTD), but this is proving attractive for KIPREIT, which commands 8.4-8.4% yields in FY19-20E. KIPREIT is currently trading below its IPO price of RM1.00 and 20% discount to NAV which we believe is unwarranted due to its fairly stable earnings backed by resilient assets, which mostly comprises of supermarkets selling daily staples, fresh market and F&B (38% of GRI), as well as other essentials, such as apparels (23% of GRI), home décor (11% of GRI), and IT & electronics (11% of GRI).

Near-term neutral but long-term positive on AEON Mall Kinta City acquisition for RM208.0m (announced in August 2018), which is expected to be completed by 2QCY19 (4Q19). We are fairly neutral on the acquisition for the near term as the estimated asset NPI yield of 5.5% is in line with most malls’ yields of c.4.5-6.0%, while we estimate the impact to bottom-line is not overly significant (c.3% to RNI assuming full-year contribution) post accounting for higher expenses and financing cost as the acquisition will be funded mostly by borrowings. Nonetheless, we favour this acquisition due to its long-term tenure (another 7 year lease up to 2025) which provides long-term earnings stability (refer overleaf).

Decent fundamentals with most downside risk accounted for. FY19 is notably a major reversion year for KIPREIT with 48.4-26.3% NLA expiring for FY19-20E. However, downside risks are relatively low as 85.0% of leases expiring in FY19E have been secured. We are assuming modest low single-digit reversions which we believe are achievable.

Expect CNPs of RM35.8-36.1m in FY19-20E. Post accounting for AEON Kinta City Mall, we estimate FY19-20E earnings of RM35.8- 36.1m on stable occupancy and modest reversions. Assuming a worstcase scenario of 10% decline from current occupancy, and mildly negative reversion (-5%) on lease expiries, we believe our forecasted DPU could decline by 18-22% to 5.5-5.3 sen (implying 6.9-6.6% gross yield). However, we reiterate that this is unlikely given most FY19 expiries have been secured while outlook going forward is stable as KIPREIT operates in a resilient market segment that targets daily staple goods for the low-to-mid income consumers. All in, we expect FY19-20E GDPU/NDPU of 6.73-6.78 sen/6.06-6.10 sen implies 8.4- 8.4% gross yields (7.5 -7.6% net yields). Most large cap MREITs (>RM1b) are commanding average net yield of 5.8%, while small-mid cap MREITs (

Trading Buy with a FV of RM0.950. Since our report dated (10th Aug 2017), we are assuming a lower DPU payout ratio of 95% (from 98%) to be prudent. We also increase our spread to +2.9ppt (from +2.7ppt) to our 10-year MGS target of 4.20%, higher than applied spreads for large cap retail MREITs (+1.4 to +2.4ppt) which typically carries a premium (i.e. thinner spreads) on reputable asset quality and perceived ability to command better rental reversions from high-end tenants and larger market cap size (>RM1b). We view our valuations as conservative considering KIPREIT’s stable earnings and positive reversions thus far (since IPO). Even so, attractive gross yield of 8.4% is hard to resist.

OTHER POINTS

Potential for more acquisitions. Post AEON Kinta City Mall acquisition, we estimate FY19-20E gearing level to be at 0.35- 0.34x, while our analysis suggests that KIPREIT is able to borrow another RM250m for future acquisition before hitting SC’s maximum gearing limit of 0.50x. Potential assets include those which KIPREIT has right of first refusal (ROFR) such as KiP Mall Kota Warisan, KiP Mart Sg. Buloh, KiP Mart Kuantan, KiP Mart Sendayan, and KiP Mart Sg. Petani. At this juncture we reckon that KiP Mall Kota Warisan is likely to be acquired first as the asset is fairly healthy with an average occupancy rate of 85% while further details on acquisition cost, funding structure and revenue contributions are speculative at this juncture.

Source: Kenanga Research - 6 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|