Kenanga Research & Investment

Daily technical highlights – (DUFU, HIBISCS)

kiasutrader

Publish date: Thu, 06 Dec 2018, 11:31 AM

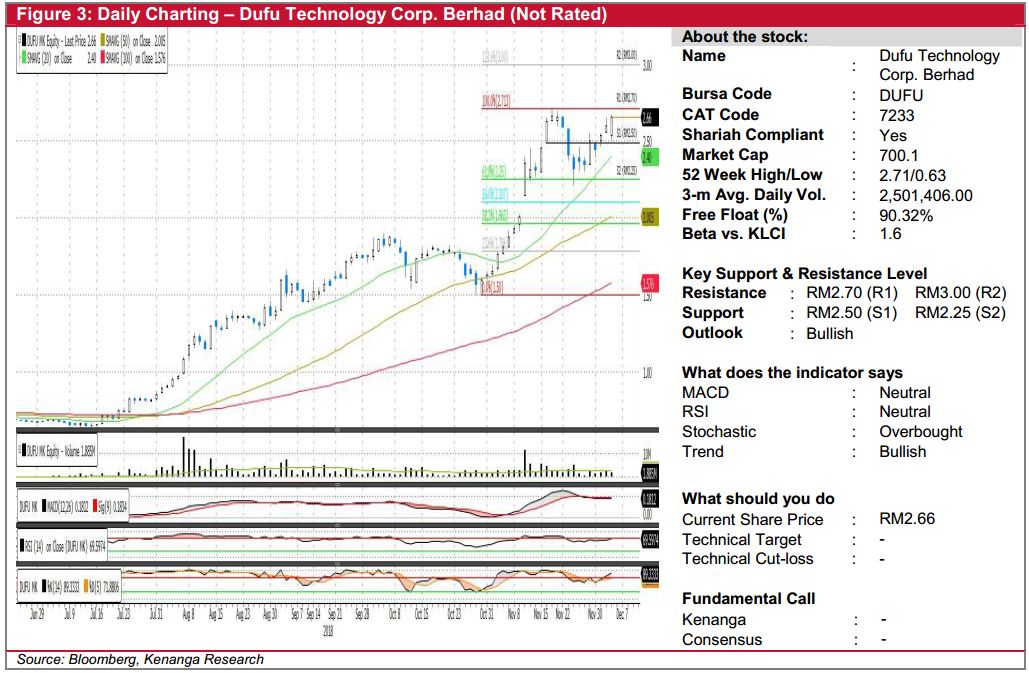

DUFU (Not Rated)

- DUFU gained 6.0 sen (+2.31%) to close at RM2.66 yesterday.

- The share has been on an uptrend since early-August with it trading above all key SMAs.

- However, we believed that DUFU may retrace soon as RSI and stochastic indicators are near the overbought level coupled with lower trading volume.

- From here, the share may retrace back to its immediate support levels at RM2.50 (S1) and RM2.25 (S2).

- Conversely, overhead resistance level can be found at RM2.70 (R1) and RM3.00 (R2).

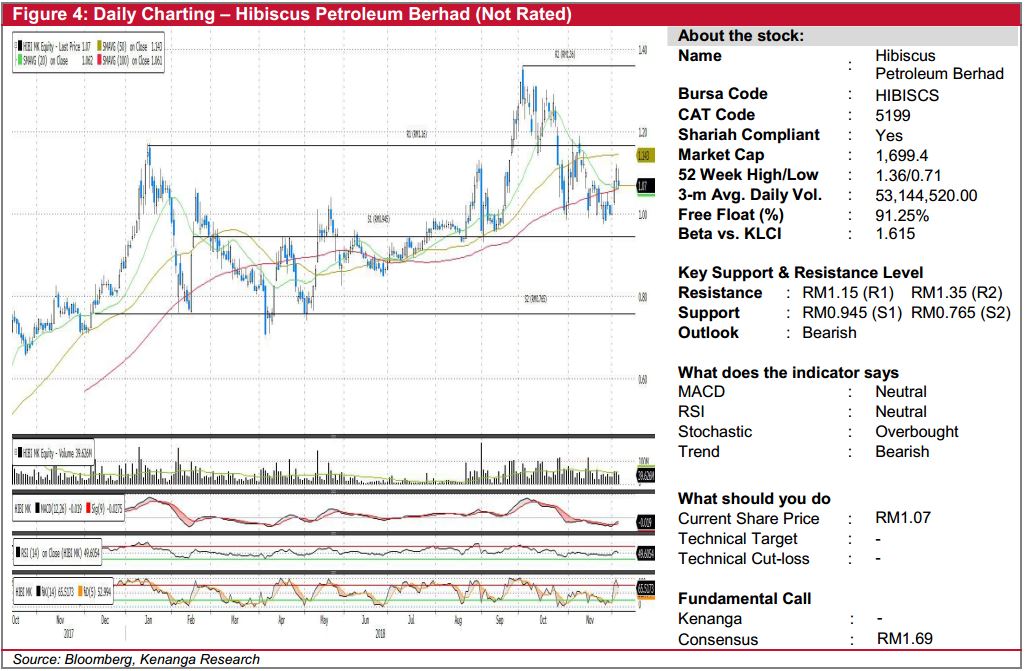

HIBISCS (Not Rated)

- HIBISCS declined by 4.0 sen (-3.60%) to end at RM1.07 yesterday.

- From October to November 2018, the share has been on a downtrend, in tandem with the decline of crude oil prices globally.

- Currently, the overall technical outlook still appears bearish despite the MACD line has crossed above the signal line with the 20 and 100-day SMAs appears to be providing support to the share.

- Should there be a positive news flow or strong sign of recovery in crude oil price, we expect it to test its immediate resistance at RM1.15 (R1) while a break above will see next resistance at RM1.35 (R2).

- Conversely, downside supports can be identified at RM0.945 (S1) and RM0.765 (S2).

Source: Kenanga Research - 6 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments