Daily technical highlights – (PENTA, MYEG)

kiasutrader

Publish date: Thu, 20 Dec 2018, 08:57 AM

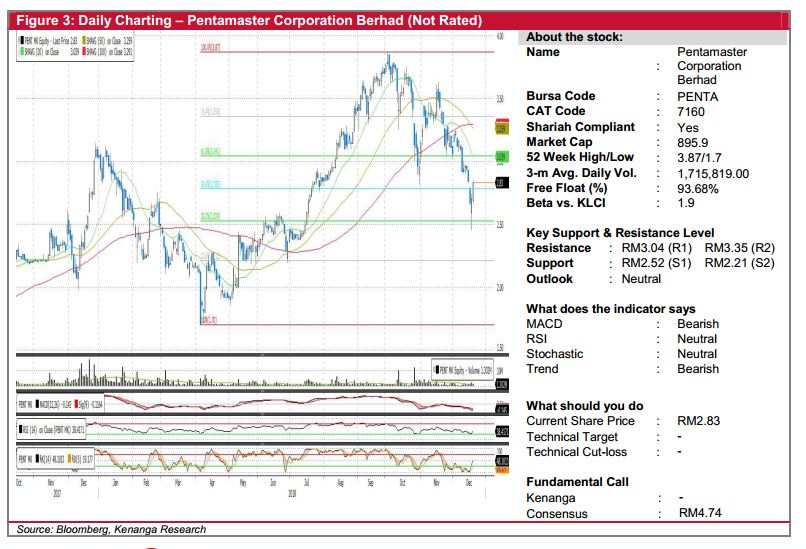

PENTA (Not Rated)

• Yesterday, PENTA rose 13.0 sen (+4.82%) to close at RM2.83.

• Chart-wise, the share seems to be taking a breather from the downtrend that started a month ago. Notably, yesterday’s candlestick formed along bullish candle following a candlestick that is somewhat similar to that of a hammer. We believe this may be a sign of a potential recovery.

• Additionally, key momentum indicators are showing meaningful upticks, further reiterating the possibility of a rebound.

• Should the buying momentum persist, we expect it to test its resistance at RM3.04 (R1) and RM3.35 (R2).

• Conversely, support levels can be found at RM2.52 (S1) and RM2.21 (S2).

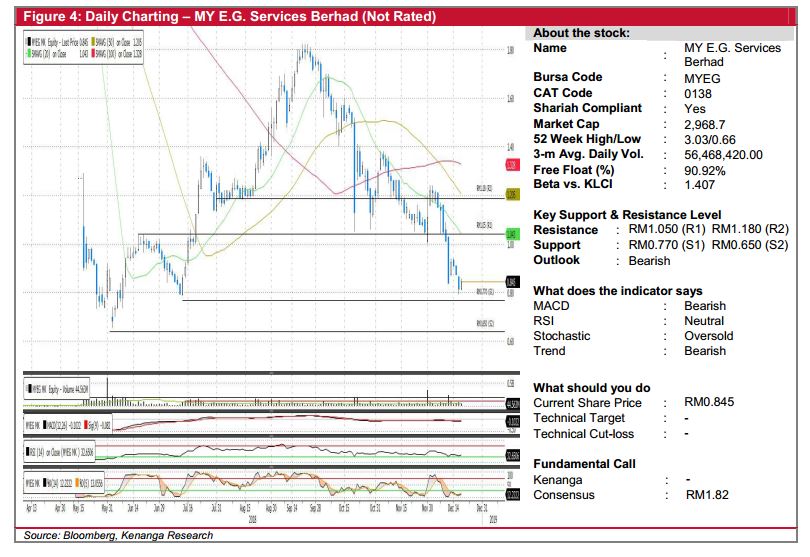

MYEG (Not Rated)

• MYEG grew by 3.0 sen (+3.68%) to end at RM0.845 yesterday.

• The share has been on a downtrend since late-September, after breaking below all its key SMAs signifying strong selling pressure.

• Although yesterday’s candlestick closed higher with the formation of a bullish candle stick, we believe that the rebound may be short-lived as RSI has remained flattish since late-September while key SMAs remained bearish.

• With lacklustre signals from key indicators, we expect the share to head to its immediate support at RM0.770 (S1) and RM0.650 (S2). Conversely, overhead resistance is seen at RM1.05 (R1) and RM1.18 (R2).

Source: Kenanga Research - 20 Dec 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|