Kenanga Research & Investment

Daily Technical Highlights – (BAHVEST, FRONTKN)

kiasutrader

Publish date: Wed, 13 Feb 2019, 09:20 AM

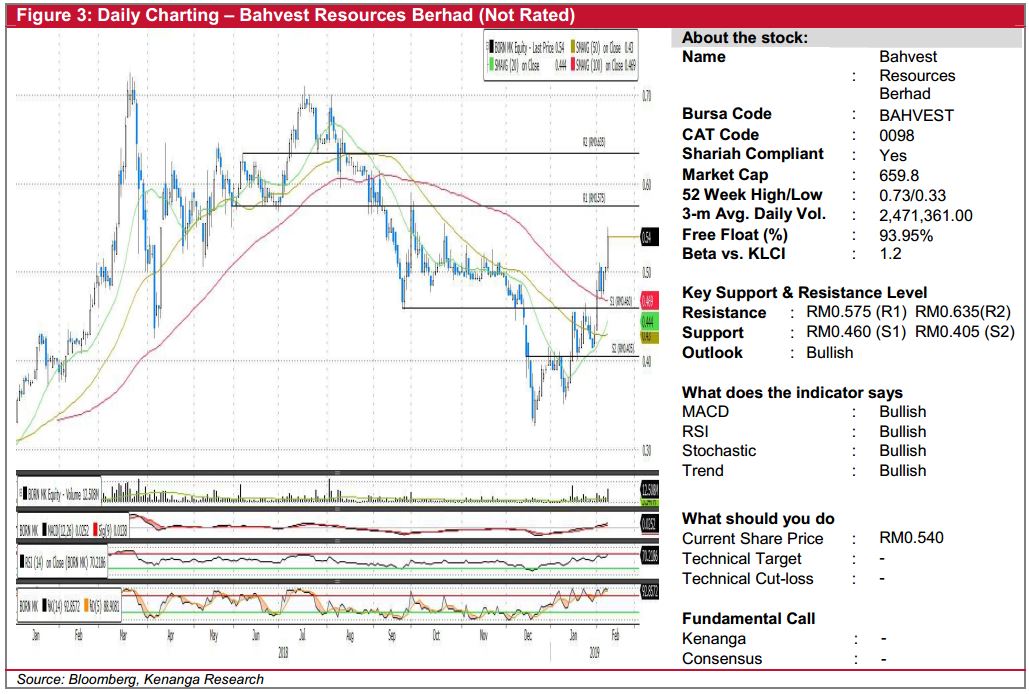

BAHVEST(Not Rated)

- BAHVEST rose 3.5sen (+6.93%) to close at RM0.540 yesterday.

- Chart-wise, the share has been on a rally since last year December. Notably, the 20- and 50-day SMAs are in a “Golden Crossover” condition, which occurred four days ago, possibly signifying a continuation of the positive buying momentum.

- Should buying momentum persist, we look towards RM0.575 (R1) and RM0.635 (R2).

- Conversely, support levels can be found at RM0.460 (S1) and RM0.405 (S2).

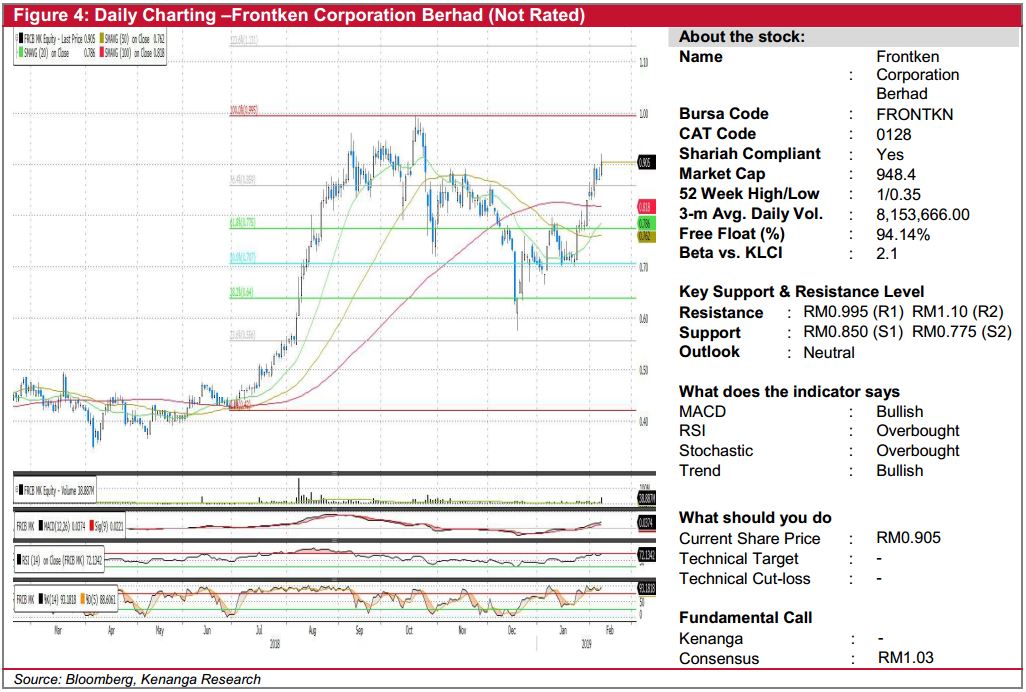

FRONTKN (Not Rated)

- FRONTKN gained 3.5 sen (+4.02%) to close at RM0.905 after announcing strong quarterly net profit figure.

- The share was on an uptrend since mid-December 2018 from a low of RM0.635.

- Despite yesterday’s gain, we think that a short-term retracement is likely to happen as the stochastic indicator has been in the overbought zone for a very long period.

- From here, expect the share to retrace back to its support levels at RM0.850 (S1) and RM0.775 (S2) in the short-term.

- Should it continue to trend upwards, resistances can be found at RM0.995 (R1) and RM1.10 (R2).

Source: Kenanga Research - 13 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

BAHVEST2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

FRONTKN2024-11-25

FRONTKN2024-11-22

BAHVEST2024-11-22

FRONTKN2024-11-21

FRONTKN2024-11-20

FRONTKN2024-11-19

FRONTKN2024-11-18

BAHVEST2024-11-18

FRONTKN2024-11-15

BAHVEST2024-11-15

FRONTKNMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments