Kenanga Research & Investment

Daily Technical Highlights – (JHM, MALAKOF)

kiasutrader

Publish date: Tue, 19 Mar 2019, 09:17 AM

JHM (Not Rated)

- JHM rose 9.0 sen (+8.11%) to close at RM1.20 yesterday.

- Chart-wise, the share has broken above its 20-day SMA, which could signal a continuation rally. Notably, yesterday saw a long bullish candlestick signifying strong buying momentum. Coupled with its 50 and 100-day SMA in a possible “GoldenCross” formation, there could be more upside.

- Should buying momentum continue, we expect the share to test its resistance at RM1.22 (R1) and further ahead at RM1.40 (R2).

- Conversely, downside supports can be found at RM1.13 (S1) and RM1.03 (S2).

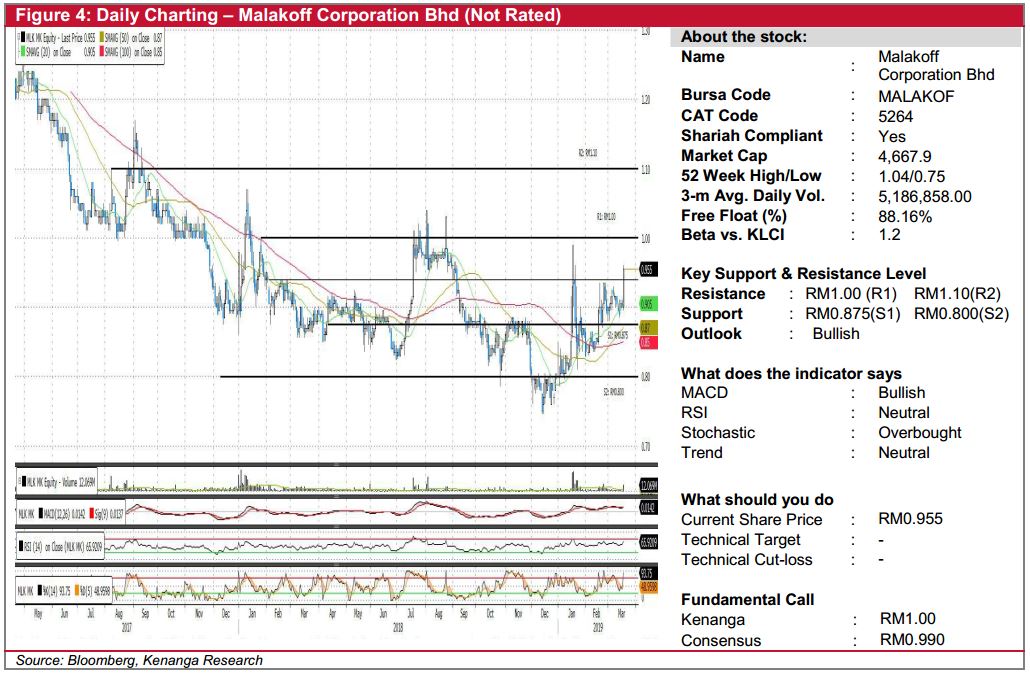

MALAKOF (Not Rated)

- MALAKOF gained 5.5 sen (+6.11%) to close at RM0.955 yesterday on the back of stronger-than-average trading volume with 12.1m shares exchanging hand, almost doubled it 20-day average.

- Yesterday’s move resulted in a decisive breakout from its RM0.940 prior resistance level; to signal more potential upside ahead.

- Momentum indicators are seemingly bullish with MACD in bullish crossover while RSI and Stochastic continuing its upward movement.

- Should it manage to decisively break above the RM1.00 (R1) resistance, we expect for next advancement towards RM1.10 (R2).

- Conversely, downside risks are identified at RM0.875 (S1) support level and RM0.800 (S2).

Source: Kenanga Research - 19 Mar 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments