Kenanga Research & Investment

Daily Technical Highlights – (JAKS, LPI)

kiasutrader

Publish date: Wed, 10 Apr 2019, 08:45 AM

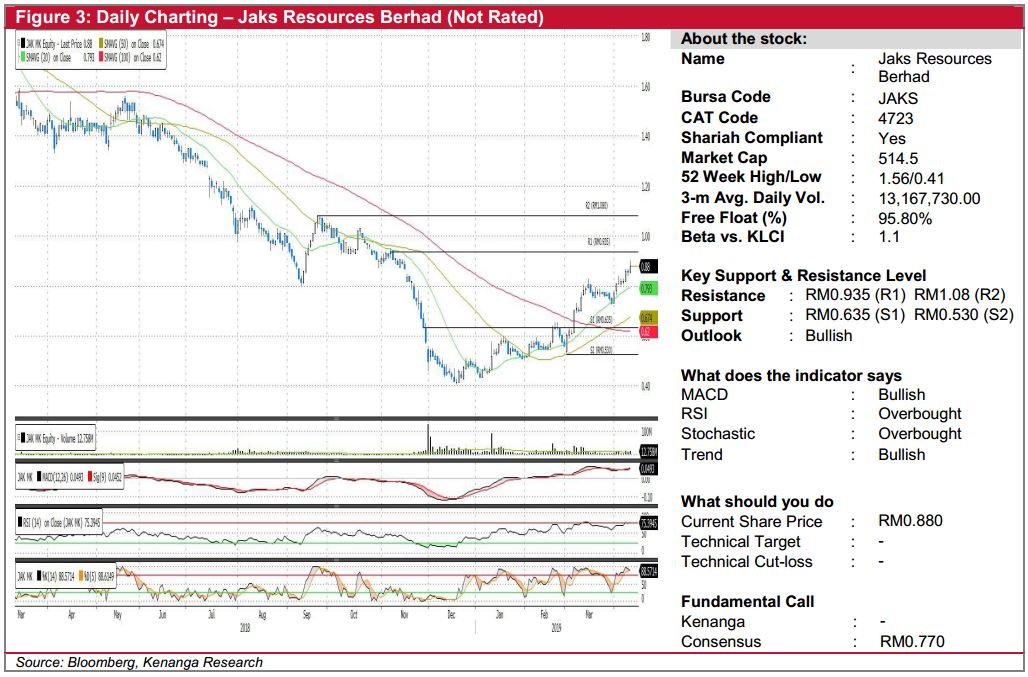

JAKS (Not Rated)

- JAKS gained 2.5 sen (+2.92%) to close at RM0.880 yesterday.

- Since mid-Dec 2018, the share has been on a rally, breaking above all key SMAs. Recently, the share has broken above its swing high, potentially signalling a continuation rally.

- Its 50-day SMA has also crossed above the 100-day SMA, a first since the “Death-Cross” in Apr-2018 which is an encouraging signal.

- Should buying momentum continue, we look towards resistances at RM0.935 (R1) and RM1.08 (R2).

- Conversely, resistance can be found at RM0.635 (S1) and RM0.530 (S2).

LPI (Not Rated)

- LPI fell 10.0 sen (-0.63%) yesterday to close at RM15.70.

- The share has been on a downward bias since breaking below its 100-day SMA in early of March. However, yesterday’s close brought LPI close to its 52-week low, which has proven to be a significant level.

- Key momentum indicators such as RSI and stochastic are also displaying oversold signals, leading us to believe that there could be some buying interest emerging for LPI soon.

- Should buying interest emerge for LPI, we opine that the share should head towards its resistance levels at RM16.02 (S1) and RM16.36 (R2).

- Support levels, on the other hand, can be identified at RM15.66 (S1) and RM15.24 (S2).

Source: Kenanga Research - 10 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments