Kenanga Research & Investment

Daily Technical Highlights – (BAHVEST, TRC)

kiasutrader

Publish date: Thu, 18 Apr 2019, 08:52 AM

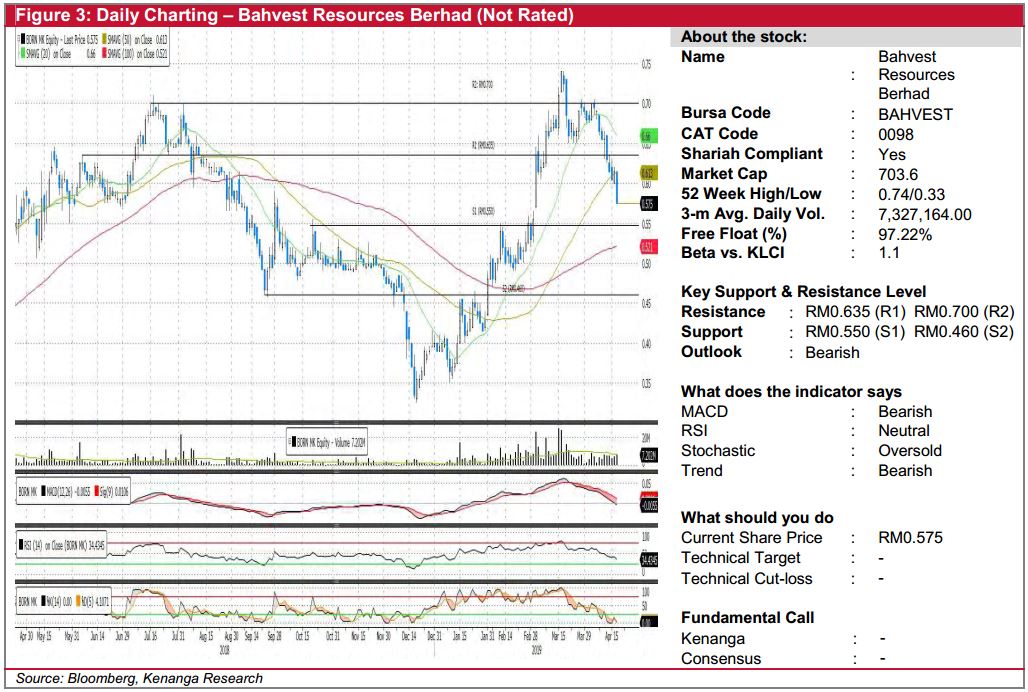

BAHVEST (Not Rated)

- BAHVEST declined by 4.0 sen (-6.50%) to close at RM0.575.

- Over the past few trading weeks, the share saw sell-down and plunged below both the 20 and 50-day SMAs.

- While outlook appears bearish, we think that it may be overdone and there might be a possibility of a rebound.

- Should it happen, we expect the share to test its resistance at RM0.635 (R1) where a break above R1 would see it rally to RM0.700 (R2).

- Conversely, continuous downward momentum will see supports at RM0.550 (S1) and even RM0.460 (S2).

TRC (Not Rated)

- TRC rose by 4.50 sen (+6.62%) yesterday to close at RM0.725.

- The share has been on a rally since mid-June last year and has since displayed healthy key SMAs.

- Yesterday chart closed with a long bullish candle stick. Despite RSI is close to the overbought region, we believe the bullish momentum could persist at key SMAs remain intact.

- Should buying momentum persist, we expect the share to test its resistance at RM0.750 (R1) and further ahead at RM0.785 (R2).

- Conversely, downside supports can be found at RM0.670 (S1) and RM0.615 (S2).

Source: Kenanga Research - 18 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments