Kenanga Research & Investment

Daily Technical Highlights – (AIRPORT, RSAWIT)

kiasutrader

Publish date: Wed, 24 Apr 2019, 09:15 AM

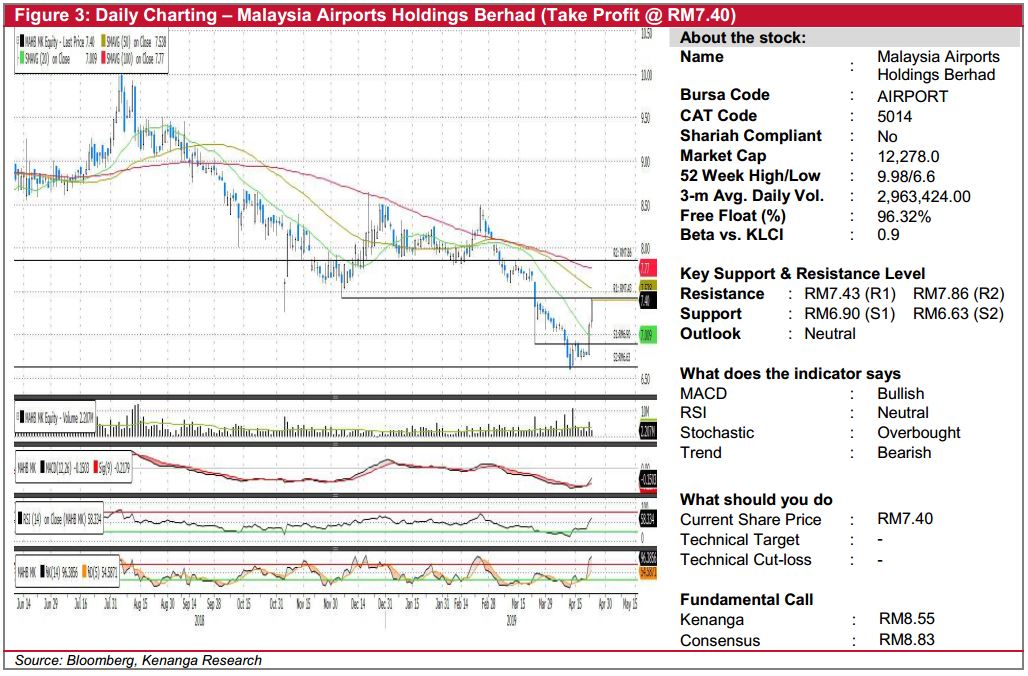

AIRPORT (Take Profit @ RM7.40)

- AIRPORT gained 29.0 sen (+4.08%) to close at RM7.40 yesterday.

- Since our “Trading Buy” call two weeks ago, the share has undergone a technical rebound and has surged past our initial target price.

- The share is now closer to its 50 and 100-day SMA where we expect to see some level of selling pressure on profit-taking. In addition, the stochastic indicator is displaying overbought signal, which could signal some selling pressure. Thus, we opt to take profit to lock in our decent gain of 12.0%.

- Should buying momentum continues, we look towards RM7.43 (R1) and RM7.86 (R2) as resistance levels. Conversely, downside supports can be at RM6.90 (S1) and RM6.63 (S2), which could serve as re-entry points.

RSAWIT (Not Rated)

- RSAWIT gained 1.0 sen (+5.00%) to close at RM0.210 on the back of stronger-than-average trading volume with 1.6m shares exchanging hand- 6 folds to its 20-day average.

- Chart-wise, RSAWIT has been in a sideways mode since January, with yesterday’s move saw the share closing above the RM0.205 prior resistance level.

- Momentum indicators appear favouring on the upside as displayed by the bullish MACD and strong upticks in RSI and Stochastic.

- From here, should buying interest be sustained, we expect the next advancement towards resistance at RM0.250 (R1) and RM0.300 (R2) next.

- Conversely, support level can be found at RM0.185 (S1) and RM0.140 (S2) further down.

Source: Kenanga Research - 24 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments