Kenanga Research & Investment

Daily Technical Highlights – (MYEG, IFCAMSC)

kiasutrader

Publish date: Tue, 07 May 2019, 08:53 AM

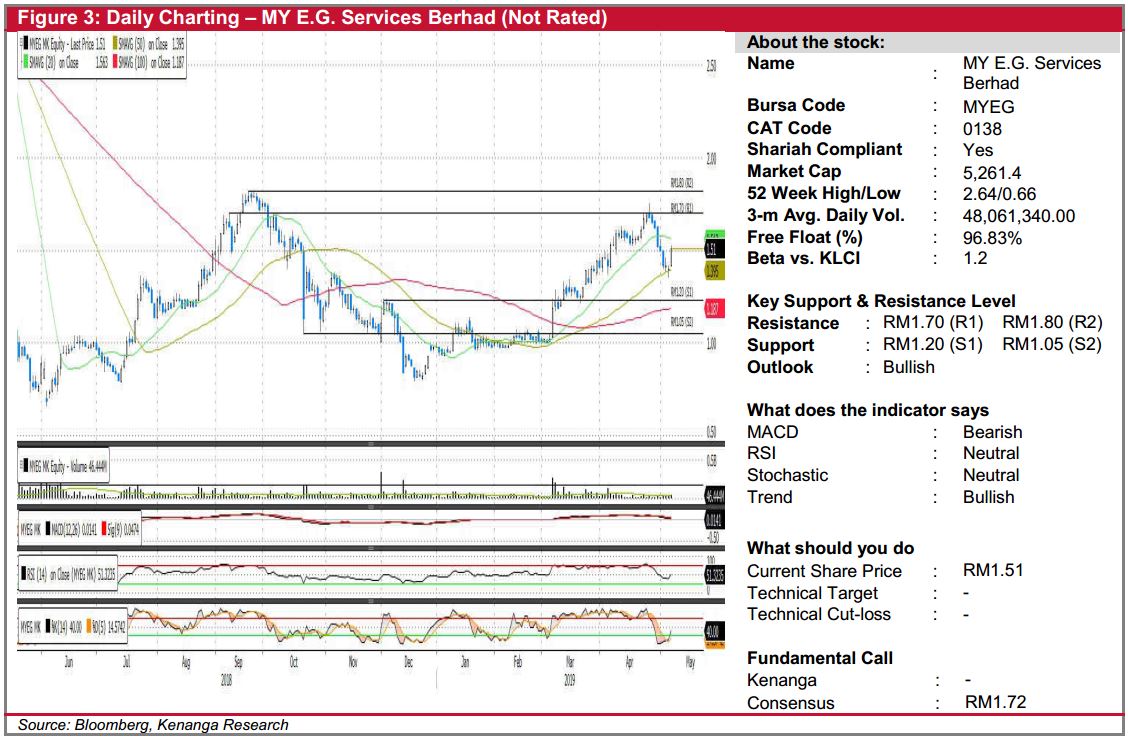

MYEG (Not Rated)

- Yesterday, MYEG surged 11.0 sen (+7.86%) to close at RM1.51.

- The share has undergone a retracement since late Apr-19 and has seemingly found support close to its 50-day SMA.

- Bouncing off from its 50-day SMA, yesterday’s long bullish candlestick leads us to believe that the retracement could be over and that there could be further room for upside. Key momentum indicators such as stochastic and RSI that are bouncing off oversold/near oversold levels support our view.

- It is expected that the share to retest its resistance at RM1.70 (R1) and RM1.80 (R2) next.

- Meanwhile, support levels can be identified at RM1.20 (S1) and RM1.05 (S2).

IFCAMSC (Not Rated)

- IFCAMSC gained 3.5 sen (+8.05%) yesterday to end at RM0.470.

- Chart-wise, the share has been trading within a range of RM0.385-RM0.490 since mid-Mar 2019.

- Yesterday’s long bullish candlestick signified buying interest. However, we believe that the lack of volume accompanying the long bullish candlestick which closed near its swing high could be hinting buying momentum that may not be sustainable.

- Should volume emerge to accompany buying momentum, we expect a retest of RM0.490 (R1), where a decisive break above would pave way for IFAMSC to move higher, say, towards RM0.555 (R2).

- Conversely, support levels can be found at RM0.425 (S1) and RM0.385 (S2).

Source: Kenanga Research - 8 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments