Kenanga Research & Investment

Daily Technical Highlights – (FRONTKN, TEOSENG)

kiasutrader

Publish date: Fri, 10 May 2019, 09:00 AM

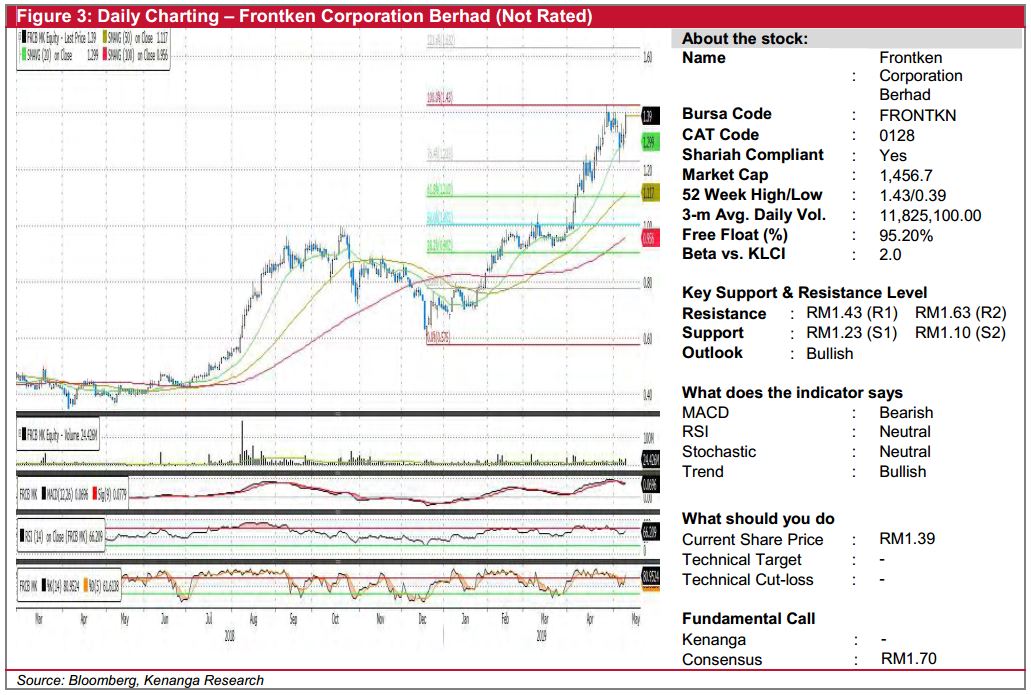

FRONTKN (Not Rated)

- Yesterday, FRONTKN gained 7.0 sen (+5.30%) to close at RM1.39.

- The share begun its rally since Jan 2019, after a period of consolidation. Yesterday’s candlestick formed a long bullish candlestick accompanied by above-average trading volume, signifying buying interest.

- Key SMAs indicate that the uptrend is still intact and upticks from key momentum indicators lead us to believe that the rally could yet be over.

- The first key resistance level to look out for is its previous swing high at RM1.43 (R1) and the next, higher at RM1.63 (R2).

- Any downward bias should see supports coming in at RM1.23 (S1) and RM1.10 (S2).

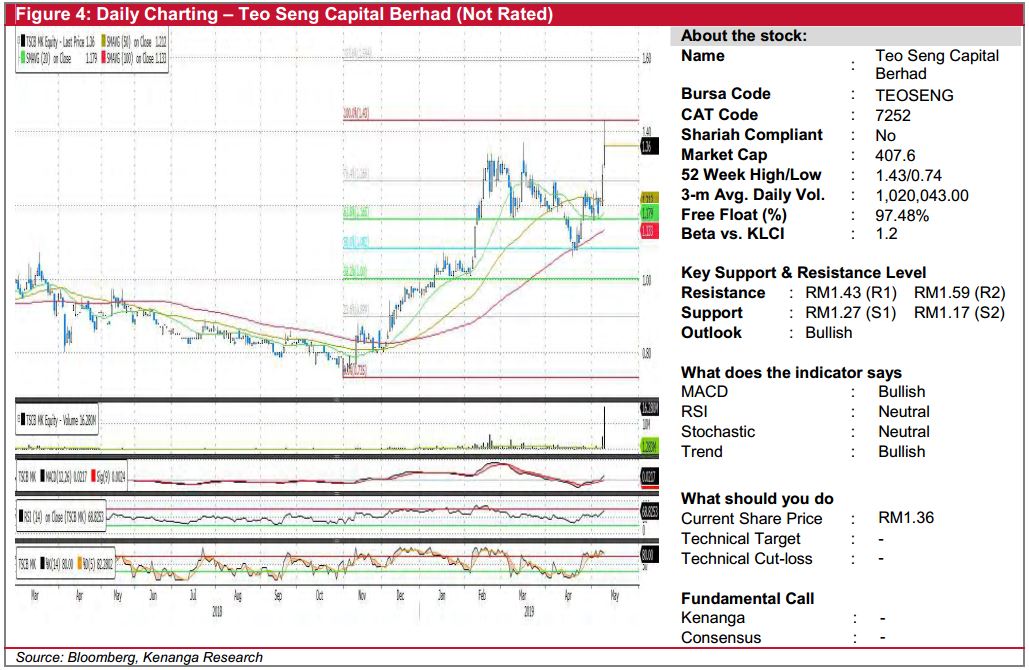

TEOSENG (Not Rated)

- TEOSENG gained 8.0 sen (+6.25%) yesterday to end at RM1.36.

- Yesterday’s close formed a candlestick with long upper wick, which signifies strong selling pressure. This, on the back of exceptional trading volume, leads us to believe that RM1.43 is a strong resistance level.

- After failing to close above this significant level, we believe the share is likely to consolidate in the near-term before a retest of the said level. This is supported by stochastic and RSI indicators which exhibit overbought/near overbought signals.

- Nevertheless, should buying momentum continue, expect to see the share move to its resistance levels of RM1.43 (R1) and RM1.59 (R2). Conversely, support levels can be seen at RM1.27 (S1) and RM1.17 (S2).

Source: Kenanga Research - 10 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments