Kenanga Research & Investment

Daily Technical Highlights – (YNHPROP, ANNJOO)

kiasutrader

Publish date: Tue, 14 May 2019, 08:54 AM

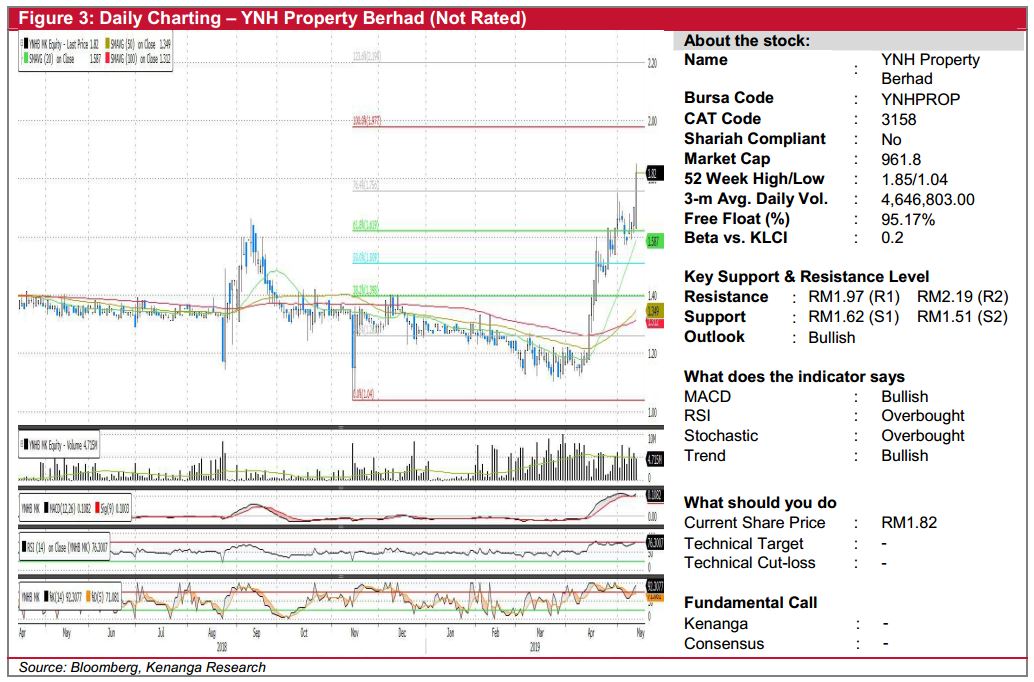

YNHPROP (Not Rated)

- Yesterday, YNHPROP gained 12.0 sen (+7.06%) to close at RM1.82.

- After a period of consolidation, the share begun its rally in April 2019. Notably, yesterday’s move saw the formation of a long bullish candlestick accompanied by above-average trading volume, signifying continued buying interest.

- Key SMAs indicate that the overall uptrend still remains intact, which led us to believe that there could be further room for upside.

- Should the buying momentum persist, expect to see the share move to its resistance levels of RM1.97 (R1) and RM2.19 (R2).

- Conversely, support levels can be identified at RM1.62 (S1) and RM1.51 (S2).

ANNJOO (Not Rated)

- ANNJOO slid 7.0 sen (-4.46%) to close RM1.50 yesterday.

- Chart-wise, the share seems to be undergoing a period of retracement since April 2019, which saw it trading below most of its Key SMAs. Furthermore, yesterday’s close saw the share close below its 100-day SMA, which may be suggesting further downwards selling pressure.

- Expect the share to find supports at RM1.28 (S1) and RM1.16 (S2).

- Conversely, resistance levels are identified at RM1.59 (R1) and RM1.74 (R2).

Source: Kenanga Research - 14 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments