Kenanga Research & Investment

Daily Technical Highlights – (INARI, PERDANA)

kiasutrader

Publish date: Fri, 24 May 2019, 09:13 AM

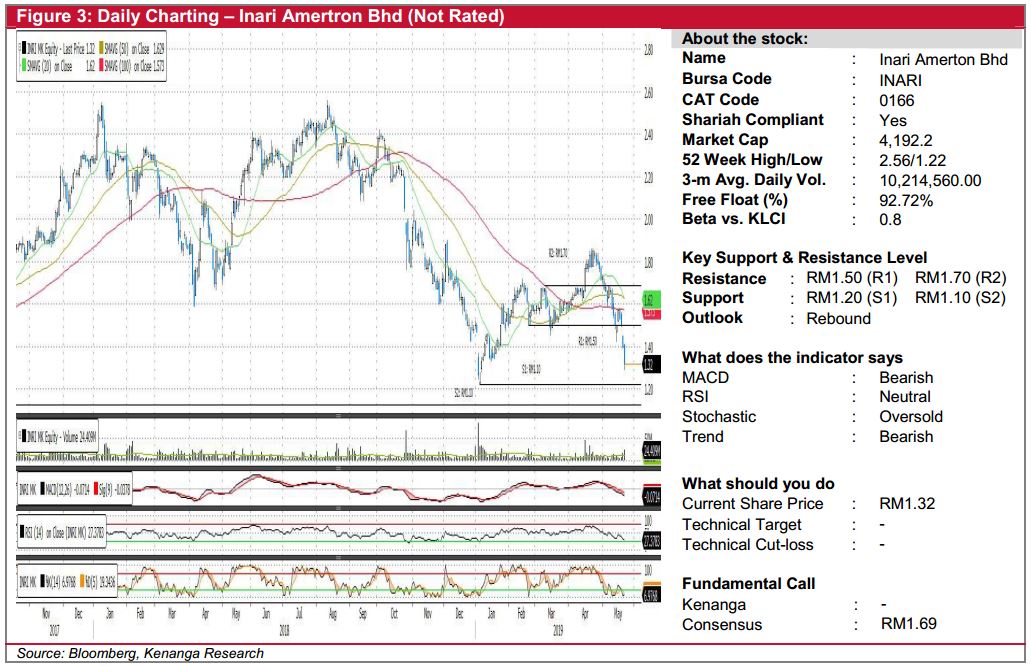

INARI (Not Rated)

- INARI fell 8.0 sen (-5.71%) to close at RM1.32 yesterday.

- Chart-wise, the share saw heavy sell-down, declining by close to 16% over the past four trading days.

- We believe the past few days’ movement may have been overdone as RSI and stochastic indicators are in the oversold zone.

- From here, we think that the share may stage a rebound and test its immediate resistance at RM1.50 (R1). Should it be able to break above R1, next resistance would then be at RM1.70 (R2).

- On the other hand, downside supports can be found at RM1.20 (S1) and RM1.10 (S2).

PERDANA (Not Rated)

- PERDANA plunged 12.9% (-4.0 sen) to close at RM0.270.

- The share saw major sell-down over the past few days that saw it broke below all key SMAs.

- All technical indicators are also bearish, with no sign of a reversal at play.

- We think that the share is likely to fall further to its support at RM0.220 (S1) and RM0.190 (S2).

- Conversely, resistances are identified at RM0.320 (R1) and RM0.350 (R2) if there is positive catalyst or news flow for the stock.

Source: Kenanga Research - 24 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments