Kenanga Research & Investment

Daily Technical Highlights – (HOMERIZ, DUFU)

kiasutrader

Publish date: Wed, 10 Jul 2019, 09:13 AM

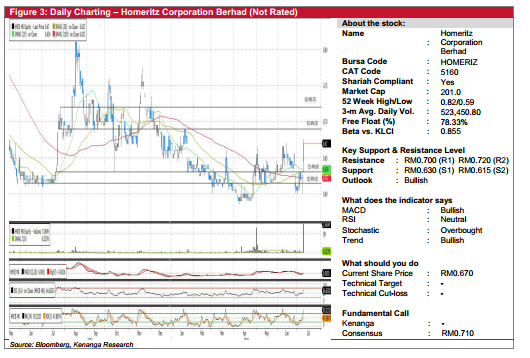

HOMERIZ (Not Rated)

- HOMERIZ gained 4.5 sen (+7.20%) to close at RM0.670.

- The share has been going through a consolidation since early-May.

- Yesterday candlestick closed above all key-SMAs backed by above-average trading volume and strong buying interest.

- Given its RSI that is still trending within its neutral zone, we believe there could be room for the share to rally and test overhead resistances at RM0.700 (R1) and RM0.720 (R2).

- Conversely, downside support can be seen at RM0.630 (S1) and RM0.615 (S2).

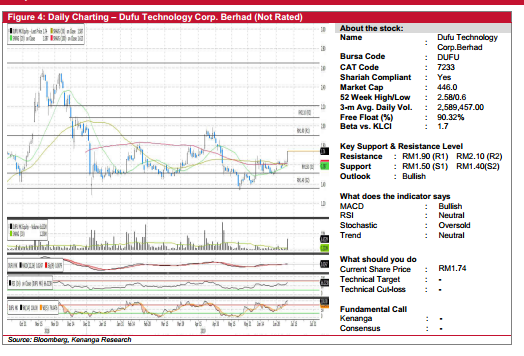

DUFU (Not Rated)

- DUFU increased by 11.0 sen (+6.75%) to end at RM1.74 yesterday.

- Chart-wise the share has been gradually trending above all key-SMAs since with the formation of a saucer pattern.

- Yesterday, candlestick saw the formation of a “Marubozu” pattern, which indicates strong buying interest. Coupled with a Bullish MACD-Crossover, we believe the share could trend higher.

- Should buying momentum persist, key resistances can be seen at RM1.90 (R1) and RM2.10 (R2).

- Conversely, key support level is seen at RM1.50 (S1) and RM1.40 (S2).

Source: Kenanga Research - 10 Jul 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments