Kenanga Research & Investment

Daily Technical Highlights – (MBMR,GBGAQRS)

kiasutrader

Publish date: Fri, 02 Aug 2019, 09:16 AM

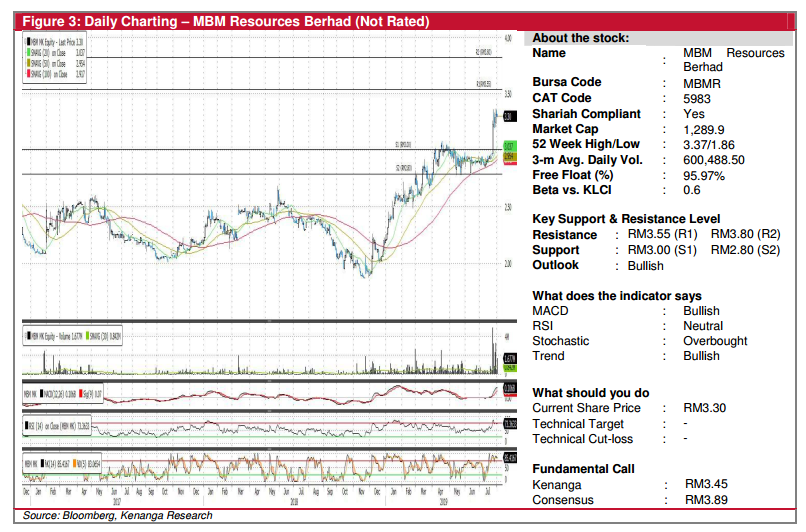

MBMR (Not Rated)

- Yesterday, MBMR remained unchanged at RM3.30.

- Chart-wise, the underlying uptrend remains intact with the share currently trading well above its key SMAs.

- Moreover, we note that the share managed to hold above its 1-year swing high following the formation of a long white candlestick last week. Coupled with stronger-than-average trading volumes and a bullish MACD formation, we believe that there may be more room for upside.

- Expect the share to trend upwards to test its resistance levels at RM3.55 (S1) and RM3.80 (S2).

- Conversely, support levels can be identified at RM3.00 (S1) and RM2.80 (S2).

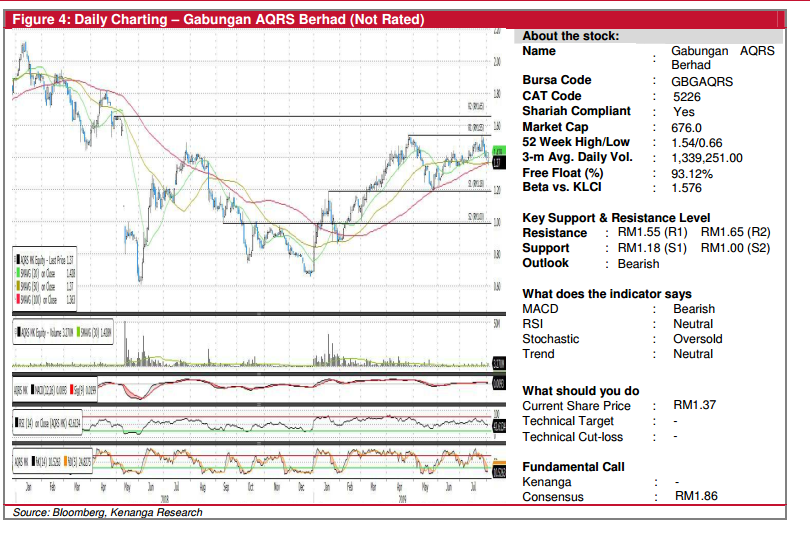

GBGAQRS (Not Rated)

- GBGAQRS was down by 3.0 sen (-2.14%) yesterday to end at RM1.37.

- Chart-wise, the share has been trending between a range of RM1.18 and RM1.55 since March’19. Nevertheless, past few days’ bearish momentum have prompted the share to test its supports at the longer-term SMAs after punching below its 20- day SMAs.

- Should the share decisively close below its longer-term SMAs, expect the share to trend lower to find supports at RM1.18 (S1) and RM1.00 (S2).

- Conversely, resistance levels can be identified at RM1.55 (S1) and RM1.65 (S2).

Source: Kenanga Research - 2 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments