Kenanga Research & Investment

Daily Technical Highlights – (KOSSAN,DRBHCOM)

kiasutrader

Publish date: Thu, 08 Aug 2019, 09:34 AM

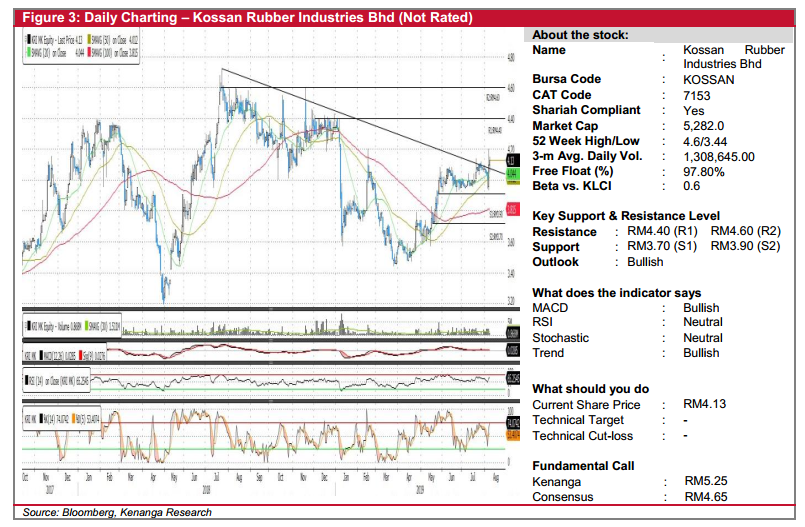

KOSSAN (Not Rated)

- KOSSAN gained 3.0 sen (+0.73%) to close at RM4.13 yesterday.

- Chart-wise, the share has broken above the key SMAs and downtrend line 2 days ago coupled with higher-than-average trading volume.

- Yesterday, it managed to trade higher and hold above the key SMAs and trend line provide further confirmation of the trend breakout. All in, we believe the share has more upside potential.

- Should the share continue its upward movement, the resistance levels can be found at RM4.40 (R1) and RM4.60 (R2).

- Conversely, support levels can be identified at RM3.70 (S1) and RM3.90 (S2).

DRBHCOM (Not Rated)

- DRBHCOM lost 4.0 sen (-1.52%) to end at RM2.59 yesterday.

- Chart-wise, the uptrend still remains intact coupled with bullish MACD indicator after the share hit the low at RM1.88 back in mid-May 2019.

- Recently, it has formed a “Flags” chart pattern after the share price achieved the high at RM2.71. We believe that the share could go higher after breakout from the “Flags” pattern.

- Should the breakout happen, the resistances level can be found at RM2.65 (R1) and RM2.80 (R2).

- Conversely, support levels can be identified at RM2.40 (S1) and RM2.30 (S2).

Source: Kenanga Research - 8 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-29

DRBHCOM2024-11-29

DRBHCOM2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-29

KOSSAN2024-11-28

DRBHCOM2024-11-28

KOSSAN2024-11-28

KOSSAN2024-11-28

KOSSAN2024-11-28

KOSSAN2024-11-28

KOSSAN2024-11-27

DRBHCOM2024-11-27

DRBHCOM2024-11-27

KOSSAN2024-11-27

KOSSAN2024-11-26

DRBHCOM2024-11-26

DRBHCOM2024-11-26

KOSSAN2024-11-26

KOSSAN2024-11-25

DRBHCOM2024-11-25

KOSSAN2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-21

DRBHCOM2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-19

DRBHCOM2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSANMore articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 1 of 1 comments

michaelwong

Dumb source of analysis . Drb has already passed through the resistance level of 2.65 - 2.68 on several occasions but however the tariff hikes between China and US subsequently have caused the equity markets in a jittery mode that many stocks have turned reversal. Just repeating outdated informations and analysis of no comparison .

2019-08-08 23:43