Kenanga Research & Investment

Daily technical highlights – (ALLIANZ, HLFG)

kiasutrader

Publish date: Fri, 10 Jan 2020, 10:32 AM

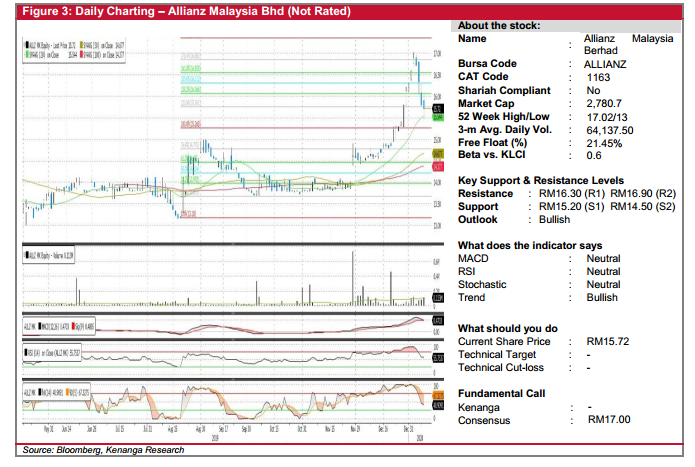

ALLIANZ (Not Rated)

- ALLIANZ fell 8.0 sen (-2.19%) to close at RM15.72.

- After experiencing a mini rally towards the end of 2019, the stock started the New Year with a downtrend which saw a fourth consecutive bearish candlestick formed yesterday.

- Coupled with the lack of positive upticks from key momentum indicators, we opine that there is more downside risk.

- Should the selling momentum persist, we expect the stock to find support at RM15.20 (S1) and RM14.50 (S2).

- Conversely, resistance levels can be seen at RM16.30 (R1) and RM16.90 (R2).

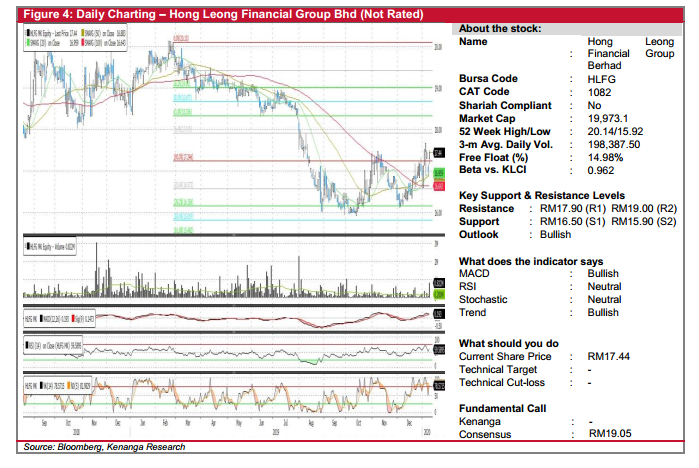

HLFG (Not Rated)

- HLFG rose 44.0 sen (+2.60%) to close at RM17.44 yesterday.

- Chart-wise, the stock appears to have staged a rebound in early December after sustaining a heavy sell-down that started in July last year.

- Overall technical outlook is positive as the MACD indicator is bullish while the stock had recently trended above the 20-day SMA.

- Expect the positive momentum to continue to lift the stock to the next resistance levels at RM17.90 (R1) and RM19.00 (R2).

- Conversely, its support levels can be found at RM16.50 (S1) and RM15.90 (S2).

Source: Kenanga Research - 10 Jan 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Local yields may rise moderately ahead of US jobs report

Created by kiasutrader | Nov 29, 2024

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments