Kenanga Research & Investment

Daily Technical Highlights: (NAIM, OCK)

kiasutrader

Publish date: Tue, 04 Aug 2020, 06:35 PM

Naim Holdings Bhd (Trading Buy)

- NAIM is expected to pay out a lump sum DPS of 18 sen within the next 12 months, which translates to an attractive dividend yield of 21.2% based on its current share price of RM0.85.

- This follows a proposal to dispose of two parcels of vacant land measuring a total area of ~405.6 ha in Bintulu, Sarawak for RM340m cash. The proceeds will be utilised for: (a) dividend payments to its shareholders (RM90m or 18 sen per share); (b) repayment of bank borrowings (RM117m); (c) working capital (RM75m); and (d) capital investments & other expenses (RM58m).

- NAIM – a property and construction player based in Sarawak which is also engaged in oil and gas services via its 26.4% stake in Dayang Enterprise Holdings Bhd – is presently trading at a PBV multiple of 0.32x (based on its book value per share of RM2.62 as of end-March 2020), or approximately 0.5SD above its historical mean.

- From a technical perspective, NAIM shares are currently in a consolidation phase after pulling back from a recent high of RM1.06 in mid-July.

- Guided by an upward sloping trendline, the stock could resume its upward trajectory to scale towards our resistance thresholds of RM0.97 (R1) (14% upside potential) and RM1.08 (R2) (27% upside potential).

- We have set our stop loss level at RM0.76 (representing a 11% downside risk).

OCK Group Bhd (Trading Buy)

- OCK offers exposure to the buoyant growth prospects of the 5G network rollout, the NFCP (National Fiberisation and Connectivity Plan) implementation and the upcoming award of large-scale solar projects.

- The Group is in the telecommunication tower business with an existing portfolio of more than 4,200 towers in Malaysia, Myanmar and Vietnam. Its other businesses are in: (i) trading of telco & network products; (ii) green energy & power solutions; and (iii) M&E engineering services.

- The Company has recently proposed to raise at least RM5.6m via a rights issue with warrants on the basis of 1 rights share for every 10 existing OCK shares held at a minimum issue price of RM0.20 per rights share, together with 1 free warrant for every 1 rights share subscribed.

- The Group made a net profit of RM6.6m (+23% YoY) in 1QFY20. Based on consensus net profit estimates of RM31m in FY Dec 2020 and RM34m in FY Dec 2021, the stock is currently trading at forward PER valuations of 15.9x this year and 14.5x next year.

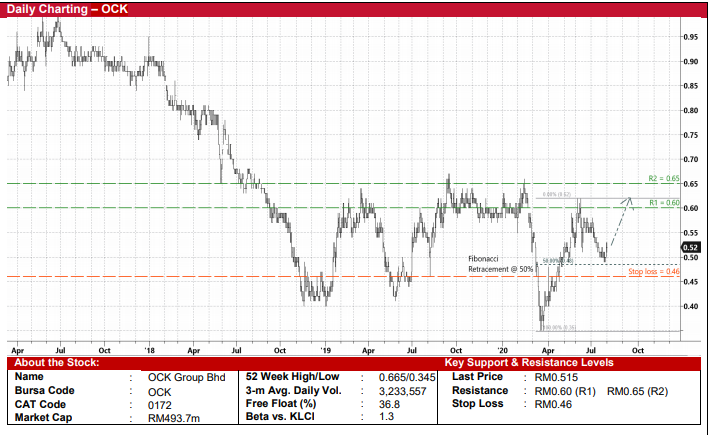

- Technically speaking, OCK appears appealing from a risk-reward perspective. After sliding from a recent high of RM0.615 on 11 June to RM0.515 currently, its shares are now trading near the key support level of RM0.48 (as identified from the Fibonacci retracement line of 50%).

- On the back of a likely share price recovery, the stock could climb to our resistance target of RM0.60 (R1) initially before challenging our next resistance barrier of RM0.65 (R2). This represents upside potentials of 17% and 26%, respectively.

- Our stop loss level is pegged at RM0.46 (11% downside risk)

Source: Kenanga Research - 4 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Aug 26, 2024

Discussions

Be the first to like this. Showing 1 of 1 comments

.png)

Stonecold

Great view

2020-08-04 22:44