Daily technical Highlights - (SAMCHEM, SCGM)

kiasutrader

Publish date: Thu, 01 Oct 2020, 02:26 PM

SAMCHEM Holdings Bhd (Trading Buy)

• SAMCHEM is a Malaysia based chemical distributor firm in South East Asia. The company operates in the (i) distribution of chemicals and (ii) blending of solvents to make customised products.

• The group is poised to benefit from the current pandemic as it is involved in the supply chain (as chemical raw material distributor) to Essential Goods Manufacturers which produces gloves, hand sanitizers, disinfectants and household care products.

• Due to the aforementioned, the group recorded a surge in net income to RM8.8m (+105%, QoQ), in 2QFY20 which is expected to continue as management indicated that they are seeing a recovery in some of the affected sectors (i.e. semiconductor, furniture and polyurethane foam products).

• Chart-wise the stock is currently forming a “Saucer Pattern”, while finding support at its 100-Day SMA. Should the buying momentum persist, we expect the stock to test its overhead resistance at RM1.00 (R1: +16% upside) and RM1.20 (R2: +40% upside).

• Our stop loss is pegged at RM0.75 (13% downside risk)

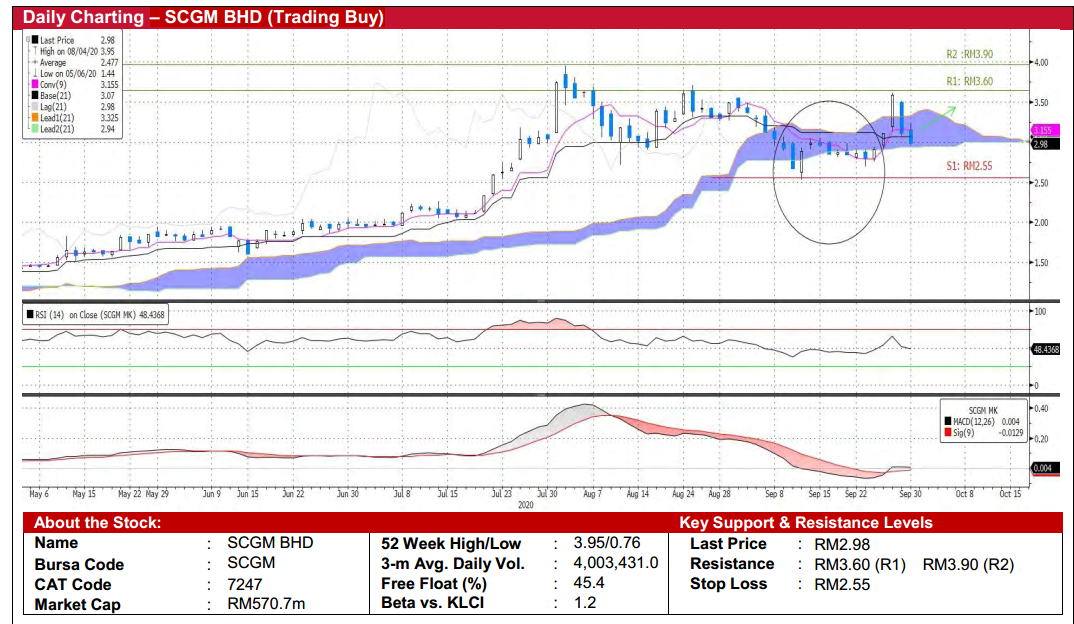

SCGM Bhd (Trading Buy)

• SCGM has delivered a strong set of results in 1QFY21, with revenue at RM57.2m (+15%,QoQ) and its bottom line at RM8.3m(+20%,QoQ).

• The better results was due to its (i) factory manpower was running at full scale utilisation rate, (ii) favourable raw material prices, and (iii) earnings contribution from its face mask production capacity.

• Going forward the group looks to have 5 face mask machines by end-September, which will bring annual capacity from 1.2m to 6m pcs/ month. On a positive note, the group has also obtained US-FDA approval for its 3-ply medical facemask in August.

• The stock has retraced from a high of RM3.95 (in early July), and has since continued to find support within the region of the Kumo Clouds. With the stock’s MACD bottoming, while it’s Kumo Cloud indicating an upward bias. We thus believe the upward movement will resume.

• Should the buying interest resume, our overhead resistance is at RM3.60 (R1: +21%, upside potential) and RM3.90 (R2: +31%, upside potential).

• Meanwhile our stop loss is pegged at RM2.55 (or 14% downside risk).

• Based on consensus estimates, the company is projected to make net profit of RM33.1m (+91%, YoY) in FY21E and RM42.8m (+16%, YoY) in FY22E. This translates to a forward PER of 17x and 15x, respectively.

Source: Kenanga Research - 1 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024