Daily Technical Highlights - (HOMERIZ, LIIHEN)

kiasutrader

Publish date: Fri, 09 Oct 2020, 09:59 AM

Homeritz Corp Bhd (Trading Buy)

• HOMERIZ is a company that designs and sells upholstery home furniture products such as: (i) leather and fabric-based sofas, (ii) dining chairs, (iii) bedframes, and (iv) lifestyle brand under the Eritz brand.

• With the on-going US-China trade war that has resulted in import tariffs on China furniture makers, furniture companies like HOMERIZ (which are located in SEA) are seeing higher orders following the trade diversion. In addition, the group stands to benefit from the work-from-home trend in U.S. given the rising Covid-19 cases.

• Chart-wise, the stock has retraced from an all-time high of RM0.825 (on 8th of September 2020) to its current level. Since then, the stock has been finding strong support near its 20-day SMA while forming a bullish pennant pattern. Should the buying interest return, we could potentially see the resumption of its uptrend.

• With that, our overhead resistance levels are positioned at RM0.79 (R1, +10% upside potential) and RM0.825 (R2, +15% upside potential).

• Meanwhile, our stop loss is pegged at RM0.67 (7% downside risk).

• Consensus is currently estimating HOMERIZ to make a net profit of RM20.1m (-9% YoY) in FY20E and RM22.5m (+12% YoY) in FY21E. This translates to low PERs of 11x and 10x, respectively.

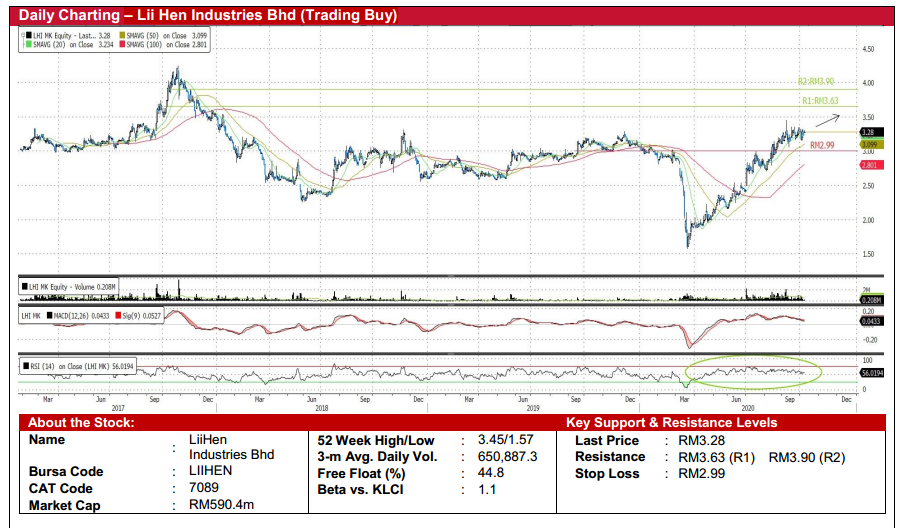

Lii Hen Industries Bhd (Trading Buy)

• LIIHEN is involved in the manufacturing and sale of furniture with a majority of its earnings (c.75% of FY19 earnings) derived from the U.S. market.

• QoQ, the group experienced a decline in net income to RM9.5m (-52% QoQ) in 2QFY20 due to the halt in its operation and shipment given the lockdown. However, we foresee a potential recovery in 2HFY20, given the: (i) resumption of activity in its factory post the lock-down, (ii) US-China trade war which will continue to benefit Malaysia’s furniture makers on the back of the trade diversion and, (iii) the work-from-home trend in U.S. which has resulted in an increase in demand for furniture.

• Despite the stock’s recent sideway movements, we believe the bullish upward momentum will persist as its shorter-term key SMA continues to trade above its medium and longer-term key SMAs. In addition, the stock’s RSI has consistently been trending above 50 (since June 2020), which indicates a sustained buying interest in the stock.

• Thus, should the buying momentum persist, our overhead resistance levels are set at RM3.63 (R1, +11% upside potential) and RM3.90 (R2, +19% upside potential).

• Meanwhile, our stop loss is pegged at RM2.99 (or 9% downside risk).

• Based on consensus estimates, the company is projected make a net profit of RM70.5m (-10% YoY) in FY20E and RM81.5m (+16% YoY) in FY21E. This translates to forward PERs of 8.4x and 7.3x, respectively

Source: Kenanga Research - 9 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Aug 26, 2024

.png)