Daily technical highlights – (OCNCASH, TEXCYCL)

kiasutrader

Publish date: Wed, 14 Oct 2020, 10:09 AM

Oceancash Pacific Bhd (Trading Buy)

• OCNCASH is principally involved in two business segments: (i) insulation felts, which are widely used in cars and airconditioners for thermal and acoustic insulation purposes; and (ii) hygiene nonwoven materials, which are used to make disposable hygiene goods (such as facial and medical protective masks, medical protective caps and gowns).

• The Group is poised to benefit from rising demand for nonwoven materials – the key raw material used in the production of Personal Protective Equipment (PPE) – which has accelerated in the wake of the Covid-19 pandemic.

• To cater to the buoyant demand, OCNCASH plans to double its annual production capacity for nonwoven materials to 16,000 tonnes within the next 18 months. The estimated capex would be RM40m, to be financed using internal funds, placements (with an ongoing private placement exercise expected to raise approximately RM17m - RM21m) and bank borrowings.

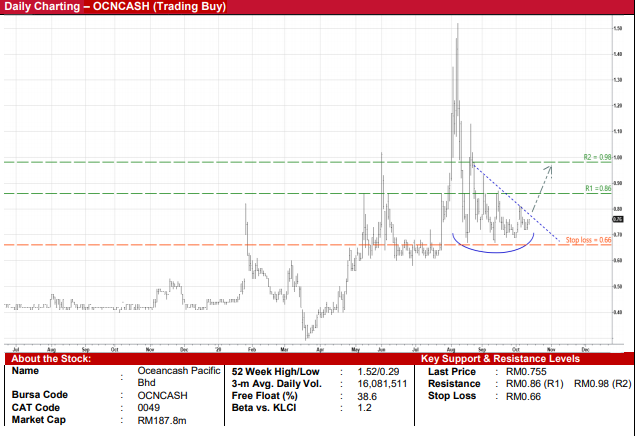

• On the chart, after sliding from a peak of RM1.52 in early August, OCNCASH shares are currently oscillating in a consolidation mode.

• A probable technical breakout from a descending trendline could push OCNCASH shares to test our resistance thresholds of RM0.86 (R1; 14% upside potential) and RM0.98 (R2; 30% upside potential) ahead.

• Our stop loss level is set at RM0.66 (which represents a 13% downside risk from its last traded price of RM0.755).

Tex Cycle Technology (M) Bhd (Trading Buy)

• TEXCYCL’s core business is in the recycling and recovery of scheduled waste, providing environmentally friendly waste management services to customers from the electronics, engineering, automobile, oil & gas and printing industries. It has also recently ventured into the solar renewable energy sector to sell electricity under the Net-Energy Metering Program to businesses and individuals.

• The Group has been profitable with annual net profit fluctuating between RM5m and RM15m over the last five years. However, its 1HFY20 earnings only came in at RM0.4m (-89% YoY) amid the disruptions in economic activities following the Covid-19 outbreak.

• Still, TEXCYCL is in a financially sound position to weather through the challenging times with net cash holdings & unit trust investments of RM14.4m (or 5.7 sen per share) as of end-June this year.

• More interestingly, TEXCYCL’s share price has overcome a descending trendline at the beginning of June to soar to a high of RM0.555 in August this year. The subsequent pullback (which is cushioned by the Fibonacci retracement line of 50%) to RM0.385 currently provides an opportunity to accumulate the stock at lower price levels.

• On the back of follow-through buying interest, the stock is expected to bounce up to our resistance thresholds of RM0.44 (R1) and RM0.49 (R2). This translates to upside potentials of 14% and 27%, respectively.

• We have placed our stop loss level at RM0.34 (or 12% downside risk).

Source: Kenanga Research - 14 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024