Daily technical highlights – (SKP, TGUAN)

kiasutrader

Publish date: Wed, 09 Dec 2020, 08:51 AM

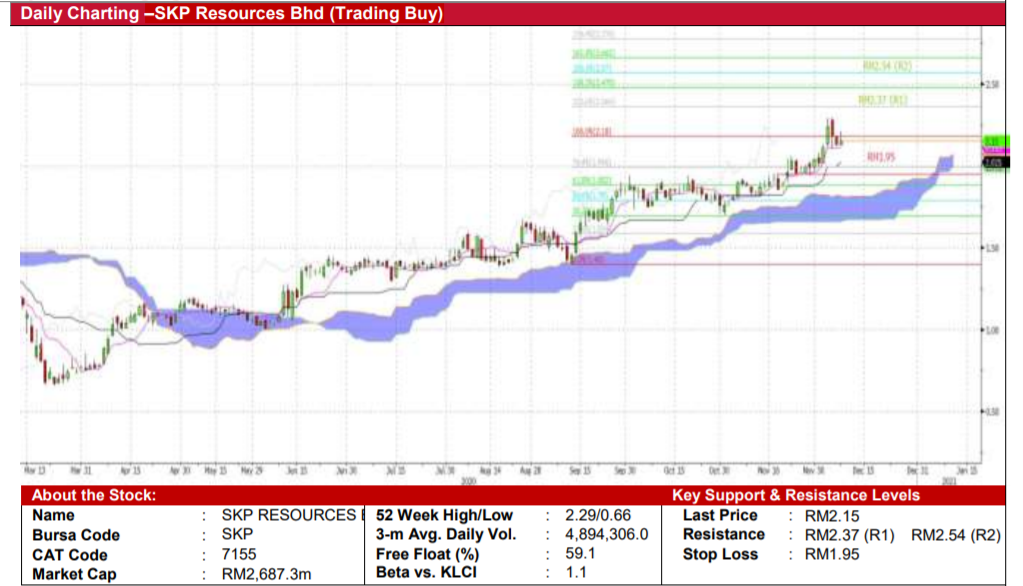

SKP Resources Bhd (Trading Buy)

• SKP Resources Bhd is a company involved in the Electronic Manufacturing Services providing plastic products for (i) computer accessories, (ii) audio accessories, and (iii) video accessories.

• QoQ, the group registered a record breaking quarter with its 2QFY21 revenue at RM726.3m (+82.3%,QoQ), while net income spiked significantly to RM44.1m(+441%,QoQ). This was due to the low based effect on its previous quarter given the MCO lockdown.

• The group indicates that it is well positioned to tap into the growing market share from its key customer, backed by their continuous effort to expand its (i) PCBA, (ii) injection moulding and (iii) engineering capabilities.

• The stock has been on a steady uptrend since the March meltdown this year. Ichimoku-wise the “Bullish Kumo” clouds continue to indicate a positive buying interest. Coupled with an uptick in RSI, we believe the stock could trend higher.

• Based on our Fibonacci projection our overhead resistance are set at RM2.37 (R1:+10%, upside potential) and RM2.54 ( R2:+18%, upside potential).

• Meanwhile, our stop loss is set at RM1.95 (-9%, downside risk).

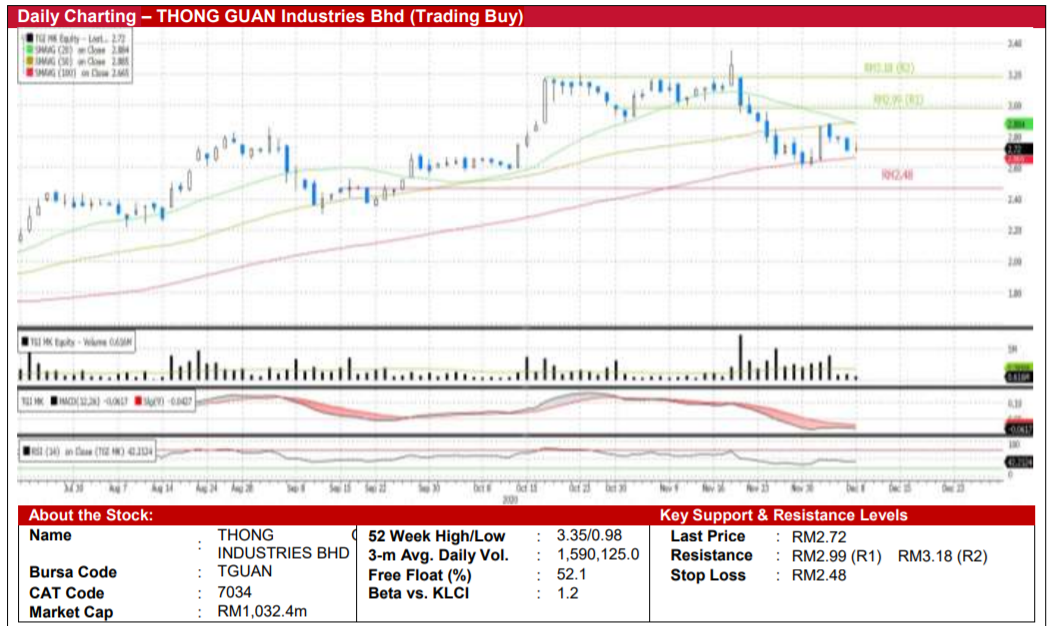

THONG GUAN Industries Bhd (Trading Buy)

• TGUAN is involved in the trading and manufacturing of plastic packaging products. The group also trades beverages including tea and coffee.

• The group managed to improve its revenue to RM245.8m(+7%,QoQ) as of 3QFY20 despite Covid-related disruptions which delayed the commissioning of an additional premium stretch film line and new premium blown film line in Europe. These were earlier scheduled to be commissioned in this quarter

• Chart-wise the stock has retraced from an all-time high of RM3.35 (18th Nov 2020) to its current level of RM2.73 which is a - 19% decline and is currently finding support at its 100-Day SMA. We believe the stock is near a rebound, given its (i) RSI in the oversold region, and (ii) shorter-term key SMA which continues to respect the longer-term key SMA.

• Should the buying momentum resume, we expect the stock to test its overhead resistance at RM2.99 (R1: 10% upside potential) and RM3.18 (R2: +16%, upside potential)

• Meanwhile, our stop loss is pegged at RM2.48 (-9%, downside risk)

• Fundamentally, the group is projected to make a net profit of RM79.5 (+28%, YoY) in FY20E and RM86.7m (+9%,YoY) in FY21E. This translates to a forward PER of 12.9x and 12.0x respectively.

Source: Kenanga Research - 9 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-28

SKPRES2024-11-27

TGUAN2024-11-26

SKPRES2024-11-26

SKPRES2024-11-26

SKPRES2024-11-26

SKPRES2024-11-25

SKPRES2024-11-22

SKPRES2024-11-22

TGUAN2024-11-22

TGUAN2024-11-21

SKPRES2024-11-21

SKPRES2024-11-21

SKPRES2024-11-21

TGUAN2024-11-21

TGUAN2024-11-21

TGUAN2024-11-20

SKPRESMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024