Daily technical highlights – (POHKONG, TOMEI)

kiasutrader

Publish date: Tue, 12 Jan 2021, 08:59 AM

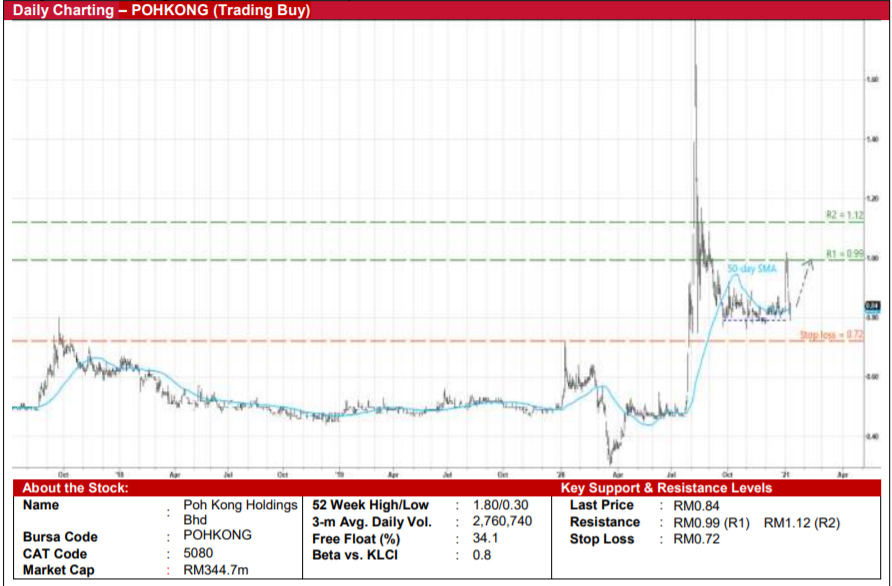

Poh Kong Holdings Bhd (Trading Buy)

• POHKONG, as a manufacturer cum retailer of jewellery in gold and gemstones, stands to benefit from: (i) higher gold prices, which would boost its profit margins given the lag effect of the gold raw material costs catching up with rising selling prices; and (ii) stronger Ringgit, as its raw materials (such as gold bars, diamonds and loose stones) are purchased in USD while the Group’s sales is denominated in Ringgit.

• With the USD (which has dropped 9% against the Ringgit since March last year) anticipated to weaken further going forward, this will likely lead to: (i) a continuation of the uptrend in gold prices, which tend to move inversely with the greenback (after the gold price has retraced 11% from a peak of USD2,075/oz in early August last year to USD1,850/oz currently); and (ii) better margins arising from lower raw material costs.

• Meanwhile, after posting net profit of RM24.4m (-3% YoY) in FY ended July 2020, the Group’s net earnings surged to RM14.6m (+81% YoY) in 1QFY21 mainly on account of higher gold prices.

• From a technical perspective, the stock is presently hovering near a horizontal support line (that has emerged following the share price’s plunge from its peak of RM1.80 in August last year) and around the 50-day SMA line.

• A likely resumption in buying interest (just like what happened early last week) could then push the stock towards our resistance thresholds of RM0.99 (R1; 18% upside potential) and RM1.12 (R2; 33% upside potential).

• Our stop loss price is pegged at RM0.72 (or 14% downside risk from yesterday’s close of RM0.84).

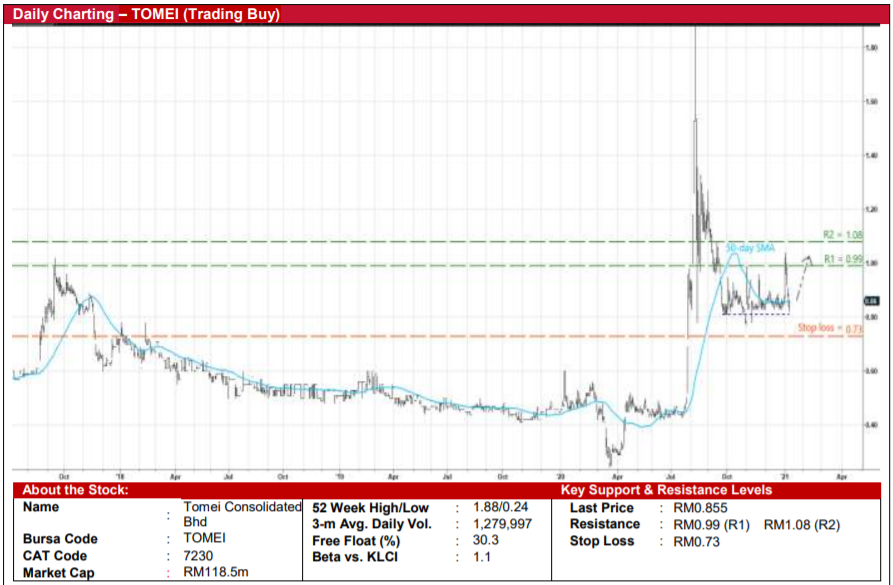

Tomei Consolidated Bhd (Trading Buy)

• TOMEI, as a manufacturer and retailer of gold, jewelleries and diamonds, is set to benefit from a weaker USD outlook, which could drive gold prices higher and lower the purchase cost of raw materials, and in turn translates to fatter profit margins for the Group.

• For 3QFY20, the Group saw its net profit jumped from RM2.1m a year ago to RM13.6m, taking its bottomline to RM19.5m (+222% YoY) for the nine-month ended September 2020 lifted by stronger profit margins.

• Technically speaking, TOMEI shares – after falling from a high of RM1.88 in August last year to settle at RM0.855 yesterday – could stage a rebound from a horizontal support line that stretches back to late September last year.

• A probable share price spurt – to break above the 50-day SMA line – will likely propel the stock to test our resistance thresholds of RM0.99 (R1) and RM1.08 (R2). This translates to upside potentials of 16% and 26%, respectively.

• We have placed our stop loss price at RM0.73 (or 15% downside risk).

Source: Kenanga Research - 12 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024