Kenanga Research & Investment

Daily technical highlights – (MAHSING, COMFORT)

kiasutrader

Publish date: Tue, 26 Jan 2021, 10:56 AM

Mah Sing Group Bhd (Trading Buy)

- From a peak of RM1.47 on 20 October last year, MAHSING shares have tumbled 44% to end at RM0.83 yesterday. The share price pullback presents an opportunity for investors to accumulate the stock, which is nearing the price level (of RM0.725) when the Group first revealed its plan on 15 October 2020 to venture into the manufacturing and trading of gloves and related healthcare products.

- According to the timeline, MAHSING would kickstart its gloves business with an initial annual production capacity of 3.68b pieces, whereby six of the 12 production lines would be ready in 2QCY21 and the remaining six lines to come onstream in 3QCY21. There is also an expansion plan under Phase 2 to install another 12 new lines with an additional yearly production capacity of up to 3.68b pieces in the future.

- Capturing the incremental earnings impact to its existing businesses (in property development and plastics manufacturing), consensus is projecting that the Group’s bottomline would jump from RM98m in FY Dec 2020 to RM226m in FY21 and RM301m in FY22. This translates to undemanding forward PERs of 8.9x this year and 6.7x next year, respectively.

- On the chart, the price uptrend remains intact as guided by an ascending trendline that stretches back to March last year. A resumption of the upward trajectory will be imminent when the stock climbs over an intermediate descending trendline.

- With the recent appearance of the bullish dragonfly doji candlesticks and the price support from a transitional horizontal line, MAHSING shares could stage a technical rebound towards our resistance thresholds of RM0.98 (R1; 18% upside potential) and RM1.05 (R2; 27% upside potential).

- We have set our stop loss price at RM0.75 (or 10% downside risk).

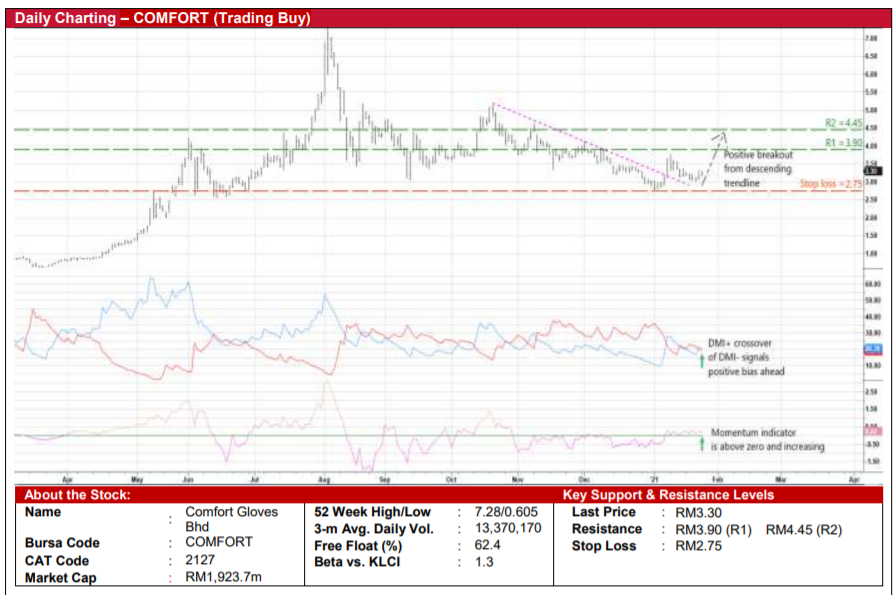

Comfort Gloves Bhd (Trading Buy)

- With the end of the global Covid-19 pandemic still not in sight yet, the high-demand low-supply of examination gloves is expected to benefit glove manufacturers like COMFORT at least for the next few quarters.

- After logging net profit of RM90.3m (up 1,119% YoY and 111% QoQ) in 3QFY21, which then lifted its bottomline to RM149.5m (+552% YoY) for the nine-month ended Oct 2020, the Group is expected to close the year on a strong footing.

- Based on consensus expectations, COMFORT’s net profit is projected to come in at RM275m in FY Jan 2021 before surging further to RM353m in FY22 and RM396m in FY23. This translates to forward PERs of 5.4x and 4.9x, respectively.

- Financially, the Group is in a steady position with net cash holdings of RM58.3m (or 10.0 sen per share) as of end-October 2020.

- From a technical perspective, the stock – following a 55% plunge from its peak of RM7.28 in early August last year – has overcome a descending trendline recently, signalling a probable price rebound ahead.

- Backed by the bullish signals of the DMI Plus crossing over the DMI Minus and the momentum indicator is on the rise above the zero-line, COMFORT’s share price could be making its way to challenge our resistance targets of RM3.90 (R1) and RM4.45 (R2). This represents upside potentials of 18% and 35%, respectively.

- Our stop loss price is pegged at RM2.75 (or 17% downside risk from yesterday’s close of RM3.30).

Source: Kenanga Research - 26 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 4 of 4 comments

Hahahhahahahhahha I'm trapped too thanks for the humor hahahahhahah

2021-01-27 17:56

Pgraduate123

Bought Tiu Nia Sing at 1.43 and have since very UnComfort able till today.

Hope limit Down soon to 0.43 sen

Top 4 made Billions also Cialat, Tiu nia Sing has nothing to prove.... Limit Down la!

2021-01-27 04:12